Question: Analyzing Transactions Using the Financial Statement Effects Template Werner Realty Company began the month with the following balance sheet. Cash ...................... $ 30,000 Liabilities................... $

Analyzing Transactions Using the Financial Statement Effects Template

Werner Realty Company began the month with the following balance sheet.

Cash ...................... $ 30,000 Liabilities................... $ 90,000

Noncash assets ............. 225,000 Contributed capital........... 45,000

Earned capital .............. 120,000

Total assets................. $255,000 Total liabilities and equity ...... $255,000

Following are summary transactions that occurred during the current month.

1. The company purchased $6,000 of supplies on credit.

2. The company received $8,000 cash from a new customer for services to be performed next month.

3. The company paid $6,000 cash to cover office rent for two months (the current month and the next).

4. The company billed clients for $25,000 of work performed.

5. The company paid employees $6,000 cash for work performed.

6. The company collected $25,000 cash from accounts receivable in transaction 4.

7. The company recorded $4,000 depreciation on its equipment.

8. At month-end, $2,000 of supplies purchased in transaction 1 are still available; no supplies were

available when the month began.

Required

a. Record the effects of each transaction using the financial statement effects template.

b. Prepare the income statement for this month and the balance sheet as of month-end.

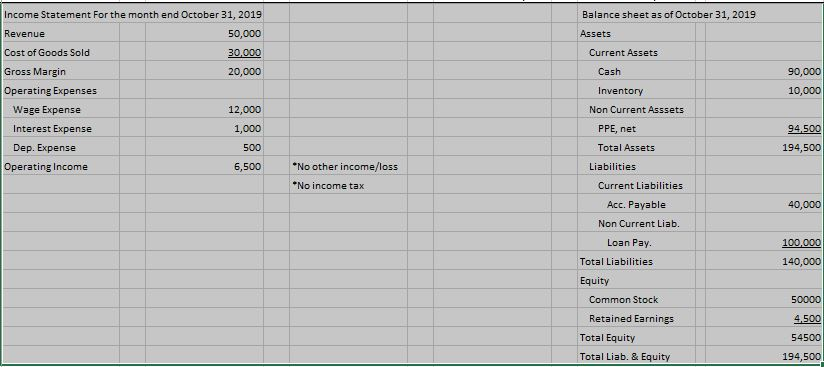

Note: For part b could you kindly prepare the Income statement and balance sheet per the attached template listing out the different accounts . I have attached an example for Income statement and Balance sheet for your reference.

Financial Effects Template:-

| Balance Sheet | Income Statement | ||||||||||||||

| Transaction | Cash Assets | + | Non- Cash Assets | = | Liabilities | + | Contributed Capital | + | Earned Capital | Revenue | - | Expenses | = | Net Income | |

Balance sheet as of October 31, 2019 Assets Current Assets Cash Income Statement For the month end October 31, 2019 Revenue 50,000 Cost of Goods Sold 30,000 Gross Margin 20,000 Operating Expenses Wage Expense 12,000 Interest Expense 1,000 Dep. Expense 500 Operating Income 6,500 90,000 10,000 Inventory Non Current Asssets PPE, net 94,500 194,500 Total Assets *No other income/loss *No income tax 40,000 Liabilities Current Liabilities Acc. Payable Non Current Liab. Loan Pay. Total Liabilities Equity Common Stock Retained Earnings Total Equity Total Liab. & Equity 100,000 140,000 50000 4,500 54500 194,500 Balance sheet as of October 31, 2019 Assets Current Assets Cash Income Statement For the month end October 31, 2019 Revenue 50,000 Cost of Goods Sold 30,000 Gross Margin 20,000 Operating Expenses Wage Expense 12,000 Interest Expense 1,000 Dep. Expense 500 Operating Income 6,500 90,000 10,000 Inventory Non Current Asssets PPE, net 94,500 194,500 Total Assets *No other income/loss *No income tax 40,000 Liabilities Current Liabilities Acc. Payable Non Current Liab. Loan Pay. Total Liabilities Equity Common Stock Retained Earnings Total Equity Total Liab. & Equity 100,000 140,000 50000 4,500 54500 194,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts