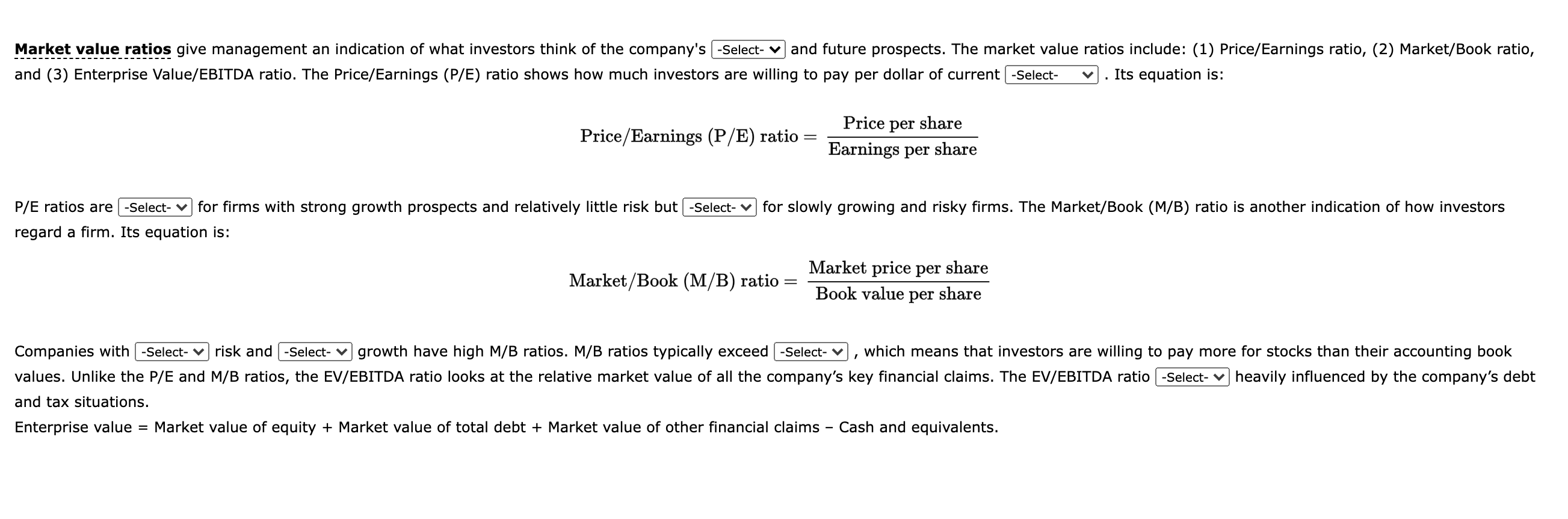

Question: and ( 3 ) Enterprise Value / EBITDA ratio. The Price / Earnings ( P / E ) ratio shows how much investors are willing

and Enterprise ValueEBITDA ratio. The PriceEarnings PE ratio shows how much investors are willing to pay per dollar of current

Price Earnings ratio

PE ratios are

Select

for firms with strong growth prospects and relatively little risk but

Select

for slowly growing and risky firms. The MarketBook MB ratio is another indication of how investors

regard a firm. Its equation is:

Market ratio

Companies with

Select

risk and

growth have high MB ratios. MB ratios typically exceed

Select

which means that investors are willing to pay more for stocks than their accounting book

values. Unlike the PE and MB ratios, the EVEBITDA ratio looks at the relative market value of all the company's key financial claims. The EVEBITDA ratio

heavily influenced by the company's debt

and tax situations.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock