Question: and a levered plan (Plan I). Under Plan I, the company would have 170,000 shares of stock outstanding. Under Plan II, there would be 120,000

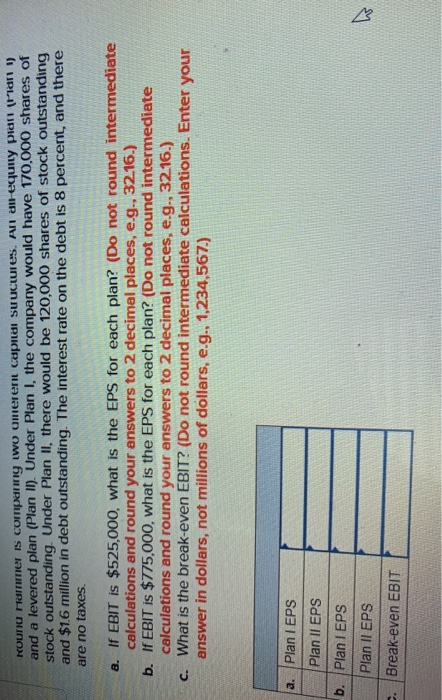

and a levered plan (Plan I). Under Plan I, the company would have 170,000 shares of stock outstanding. Under Plan II, there would be 120,000 shares of stock outstanding and $1.6 million in debt outstanding. The interest rate on the debt is 8 percent, and there are no taxes a. If EBIT is $525,000, what is the EPS for each plan? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.) If EBIT is $775,000, what is the EPS for each plan? (Do not round intermediate calculations and round your enswers to 2 decimal places, e.g., 32.16.) What is the break-even EBIT? (Do not round intermediate calculations. Enter your answer in dollars, not millions of dollars, e.g. 1,234,567) b. c. a. Plan I EPS Plan II EPS b. Plan I EPS Plan Il EPS . Break-even EBIT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts