Question: and after 2016 Boehm will return to its previous 5% earnings growth rate. Its target debt ratio is 35%. The data has been collected in

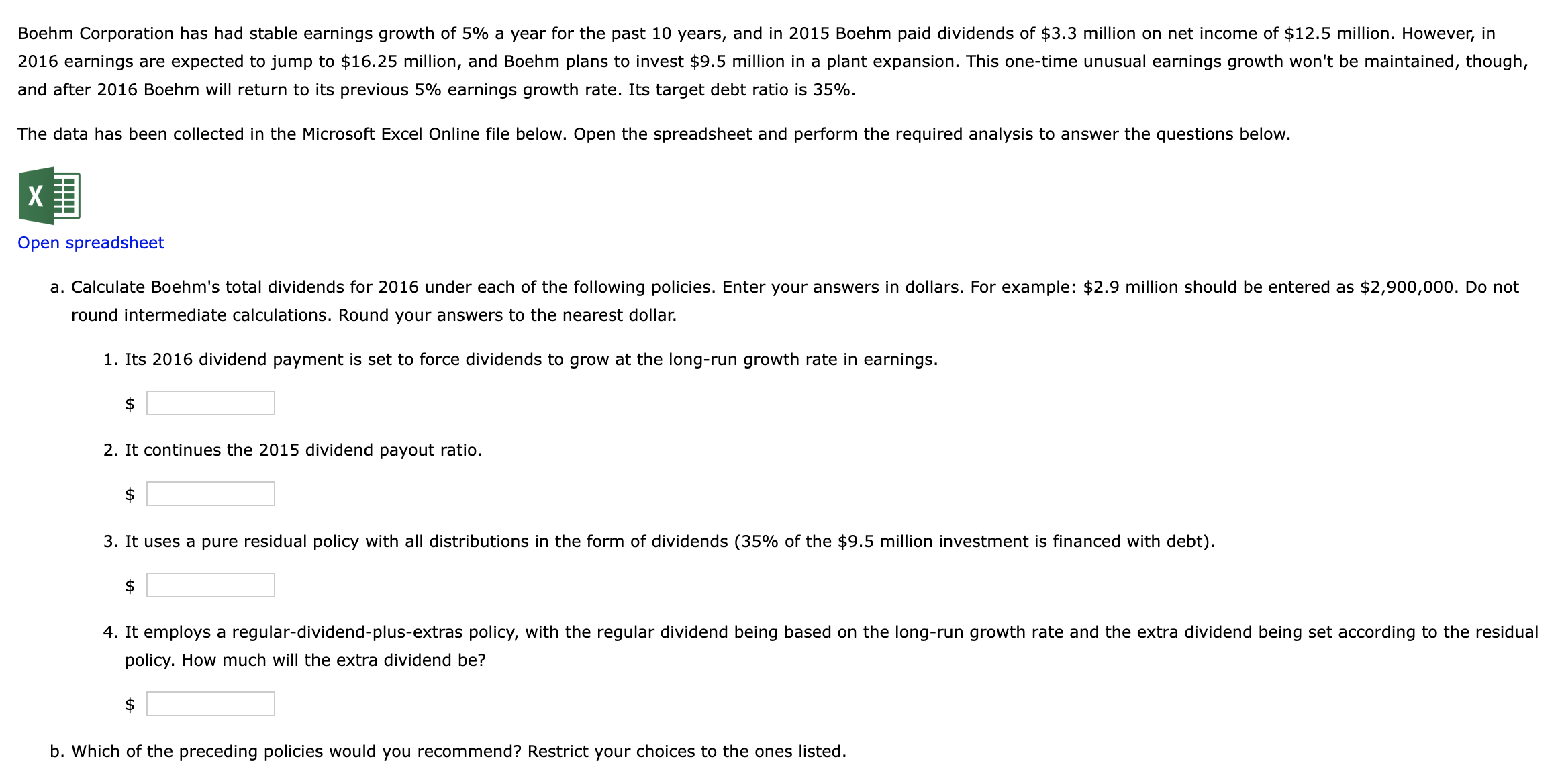

and after 2016 Boehm will return to its previous 5% earnings growth rate. Its target debt ratio is 35%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet round intermediate calculations. Round your answers to the nearest dollar. 1. Its 2016 dividend payment is set to force dividends to grow at the long-run growth rate in earnings. $ 2. It continues the 2015 dividend payout ratio. $ 3. It uses a pure residual policy with all distributions in the form of dividends ( 35% of the $9.5 million investment is financed with debt). $ policy. How much will the extra dividend be? $ b. Which of the preceding policies would you recommend? Restrict your choices to the ones listed. and after 2016 Boehm will return to its previous 5% earnings growth rate. Its target debt ratio is 35%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet round intermediate calculations. Round your answers to the nearest dollar. 1. Its 2016 dividend payment is set to force dividends to grow at the long-run growth rate in earnings. $ 2. It continues the 2015 dividend payout ratio. $ 3. It uses a pure residual policy with all distributions in the form of dividends ( 35% of the $9.5 million investment is financed with debt). $ policy. How much will the extra dividend be? $ b. Which of the preceding policies would you recommend? Restrict your choices to the ones listed

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts