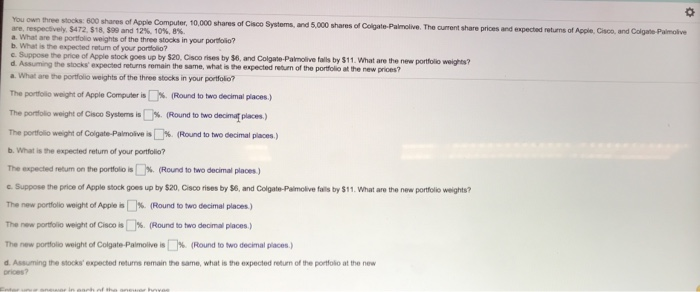

Question: And also I need the new expected return % Thanks o own three stocks: 600 shares of Apple Computer, 10,000 shares of Cisco Systems, are,

o own three stocks: 600 shares of Apple Computer, 10,000 shares of Cisco Systems, are, respectively $472. S18, S99 and 12% 10%, 8%. a. What are the portolio weights of the three stocks in your portolio? shares of Colgate-Palmolive. The current share prices and expected returns of Apple, Cisco, and Colgate Palmolve c. Suppose the price of Apple stock goes up by $20, Cisoo rises by $6, d. Assuming the stocks' expected returns remain the same, what is the expected return of the portfolio at the new prices? .what are the portfolio weights of the three stocks in your portfolo? and Colgate-Palmolive falls by $11. What are the new portfolio weights? The potolo wOght of Apple Computer is%. Round to two decimal places ) The portfolio weight of Cisco Systems is. %, found to two dont places.) The portfolio weght of Colgate-Pain.olve , % (Rond to two decimal places ) b. What is the expected retum of your portfolio? The expected return on the portio is!(Roud to two decimal places) .Suppose the price of Apple stock goes up by S20, dado rises by $6, and Colgat.Pamolve fals by $11. What am the new portfolio weights? The new portfolio weight of Apple is(Round to two decimal places) The new portfolio weight of Cisco is[)%(Round to two doornal places ) The new portfolio weightof Colgate-Patroive is %. (Roundto two deci nal places.) d. Assuming the stocks' expected returns remain the same, what is the expected return of the portfolo at the new orices

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts