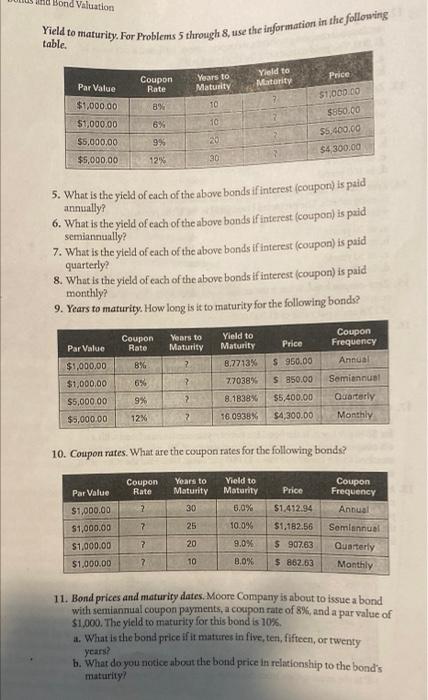

Question: and Bond Valuation Yield to maturity. For Problems 5 through 8, use the information in the following table. Price Yield to Maturity Coupon Rate Par

and Bond Valuation Yield to maturity. For Problems 5 through 8, use the information in the following table. Price Yield to Maturity Coupon Rate Par Value Years to Maturity $1,000.00 $1,000.00 8% 10 $850.00 $1,000.00 6% 10 $5,400.00 $5,000.00 9% $4,300.00 $5,000,00 12% 30 5. What is the yield of each of the above bonds if interest (coupon) is paid annually? 6. What is the yield of each of the above bonds if interest (coupon) is paid semiannually? 7. What is the yield of each of the above bonds if interest (coupon) is paid quarterly? 8. What is the yield of each of the above bonds if interest (coupon) is paid monthly? 9. Years to maturity. How long is it to maturity for the following bonds? Yield to Coupon Rate Coupon Frequency Years to Maturity Par Value Maturity Price $1,000.00 8% 2 8,7713% Annual $ 950.00 $1,000,00 6% 2 Semiannual 7.7038% $ 850.00 $5,000.00 9% ? 8.1838% $5,400.00 Quarterly $5,000.00 12% ? 16.0938% $4,300.00 Monthly 10. Coupon rates. What are the coupon rates for the following bonds? Years to Yield to Coupon Rate Par Value Maturity Maturity Price Coupon Frequency $1,000.00 2 30 6.0% $1.412.94 Annual $1,000.00 7 25 10.0% $1,182.56 Semiannual $1,000.00 20 9.0% $ 907.63 Quarterly $1,000.00 7 10 8.0% $ 862.63 Monthly 11. Bond prices and maturity dates. Moore Company is about to issue a bond with semiannual coupon payments, a coupon rate of 8%, and a par value of $1,000. The yield to maturity for this bond is 10%. a. What is the bond price if it matures in five, ten, fifteen, or twenty years? b. What do you notice about the bond price in relationship to the bond's maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts