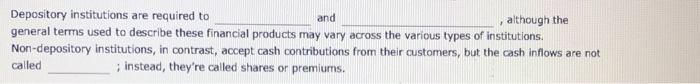

Question: and Depository institutions are required to , although the general terms used to describe these financial products may vary across the various types of institutions.

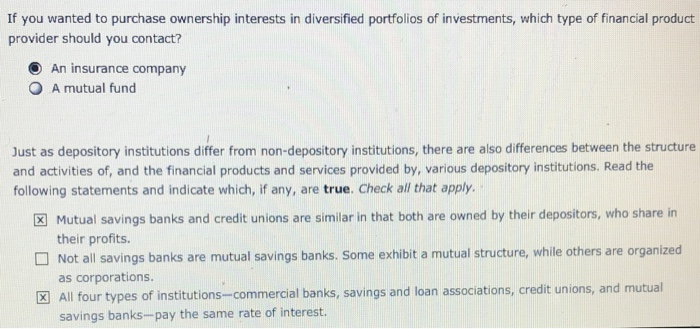

and Depository institutions are required to , although the general terms used to describe these financial products may vary across the various types of institutions. Non-depository institutions, in contrast, accept cash contributions from their customers, but the cash inflows are not called ; instead, they're called shares or premiums. If you wanted to purchase ownership interests in diversified portfolios of investments, which type of financial product provider should you contact? An insurance company A mutual fund O Just as depository institutions differ from non-depository institutions, there are also differences between the structure and activities of, and the financial products and services provided by, various depository institutions. Read the following statements and indicate which, if any, are true. Check all that apply. x Mutual savings banks and credit unions are similar in that both are owned by their depositors, who share in their profits. Not all savings banks are mutual savings banks. Some exhibit a mutual structure, while others are organized as corporations. x All four types of institutions-commercial banks, savings and loan associations, credit unions, and mutual savings banks-pay the same rate of interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts