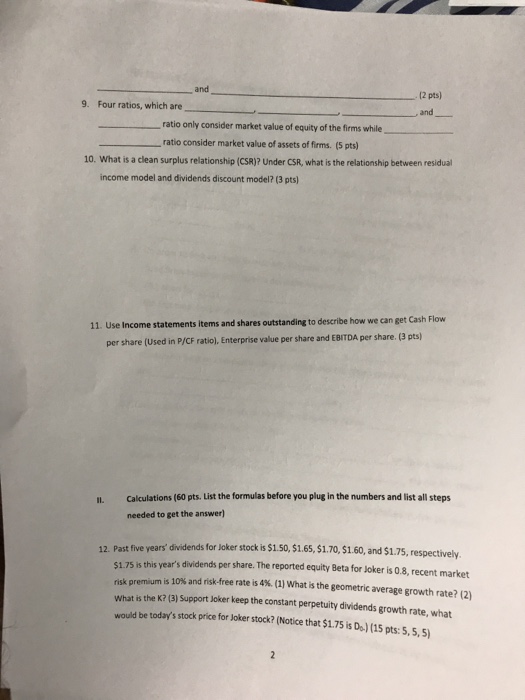

Question: _____ and ______. Four ratios, which are ______, _______, ______, and ___ ratio only consider market value of equity of the firms while _____ ________

_____ and ______. Four ratios, which are ______, _______, ______, and ___ ratio only consider market value of equity of the firms while _____ ________ ratio consider market value of assets of firms. What is a clean surplus relationship (CSR)? Under CSR, what is the relationship between residual income model and dividends discount model? Use Income statements items and shares outstanding to describe how we can get Cash Flow per share (Used in P/CF ratio), Enterprise value per share and EBITDA per share. Calculations (List the formulas before you plug in the numbers and list all steps needed to get the answer) Past five years' dividends for Joker stock is exist1.50, exist1.65, exist1.70, exist1.60, and exist1.75, respectively exist1.75 is this year's dividends per share. The reported equity Beta for Joker is 0.8, recent market risk premium is 10% and risk-free rate is 4%. (1) What is the geometric average growth rate? (2) What is the K? (3) Support Joker keep the constant perpetuity dividends growth rate, what would be today's stock price for Joker stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts