Question: And part b el Video Problem 27-41 (LO. 6, 7) At the time of Mateo's death, he was involved in the following transactions: * Mateo

And part b

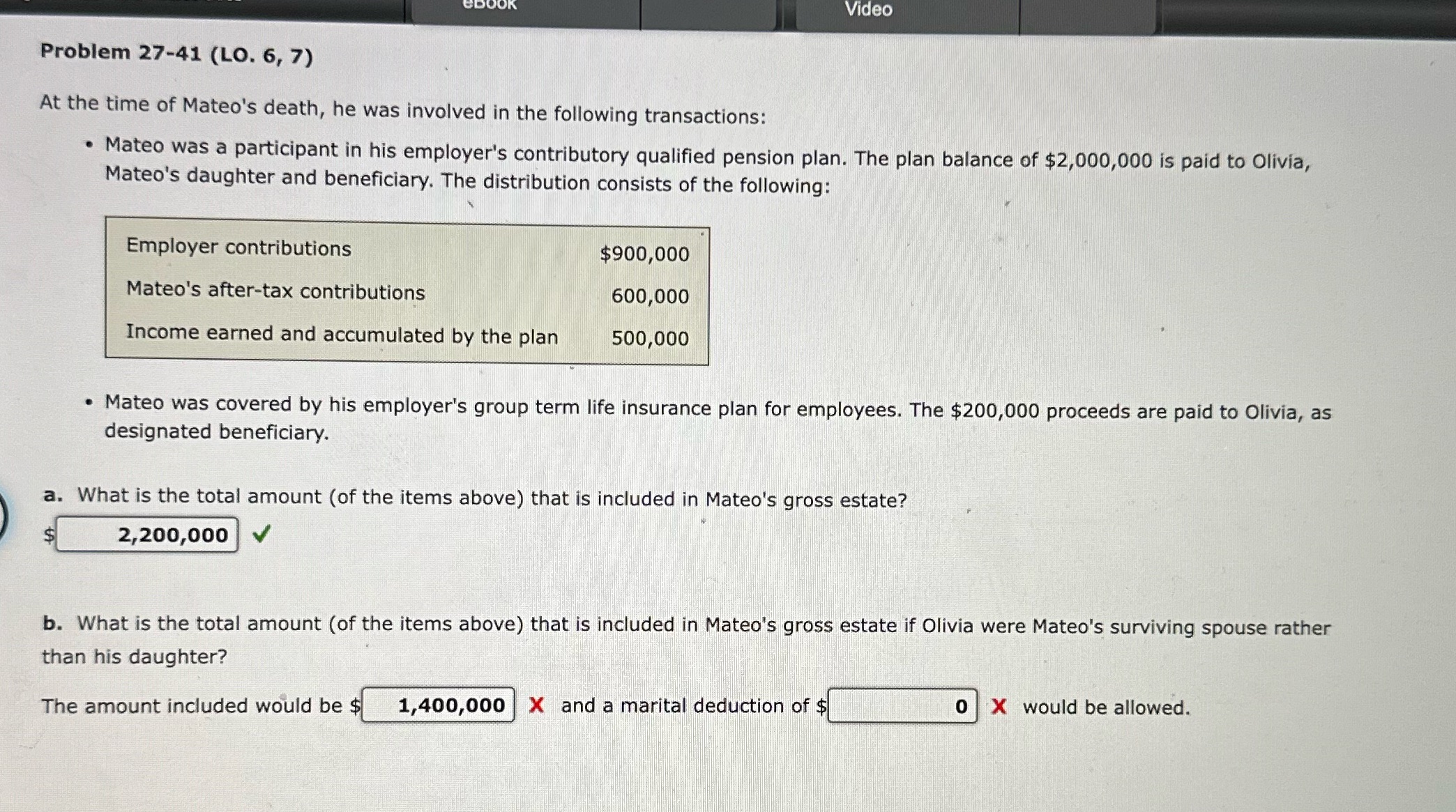

el Video Problem 27-41 (LO. 6, 7) At the time of Mateo's death, he was involved in the following transactions: * Mateo was a participant in his employer's contributory qualified pension plan. The plan balance of $2,000,000 is paid to Olivia, Mateo's daughter and beneficiary. The distribution consists of the following: N Employer contributions $900,000 . Mateo's after-tax contributions 600,000 Income earned and accumulated by the plan 500,000 * Mateo was covered by his employer's group term life insurance plan for employees. The $200,000 proceeds are paid to Olivia, as designated beneficiary. a. What is the total amount (of the items above) that is included in Mateo's gross estate? S 2,200,000 | V' b. What is the total amount (of the items above) that is included in Mateo's gross estate if Olivia were Mateo's surviving spouse rather than his daughter? The amount included would be $ 1,400,000 | X and a marital deduction of $E::a X would be allowed

el Video Problem 27-41 (LO. 6, 7) At the time of Mateo's death, he was involved in the following transactions: * Mateo was a participant in his employer's contributory qualified pension plan. The plan balance of $2,000,000 is paid to Olivia, Mateo's daughter and beneficiary. The distribution consists of the following: N Employer contributions $900,000 . Mateo's after-tax contributions 600,000 Income earned and accumulated by the plan 500,000 * Mateo was covered by his employer's group term life insurance plan for employees. The $200,000 proceeds are paid to Olivia, as designated beneficiary. a. What is the total amount (of the items above) that is included in Mateo's gross estate? S 2,200,000 | V' b. What is the total amount (of the items above) that is included in Mateo's gross estate if Olivia were Mateo's surviving spouse rather than his daughter? The amount included would be $ 1,400,000 | X and a marital deduction of $E::a X would be allowed

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock