Question: and so on Required information Problem 2.5A (Algo) Analyze the impact of transactions on the accounting equation and record transactions (LO2-2,2-4) [The following information applies

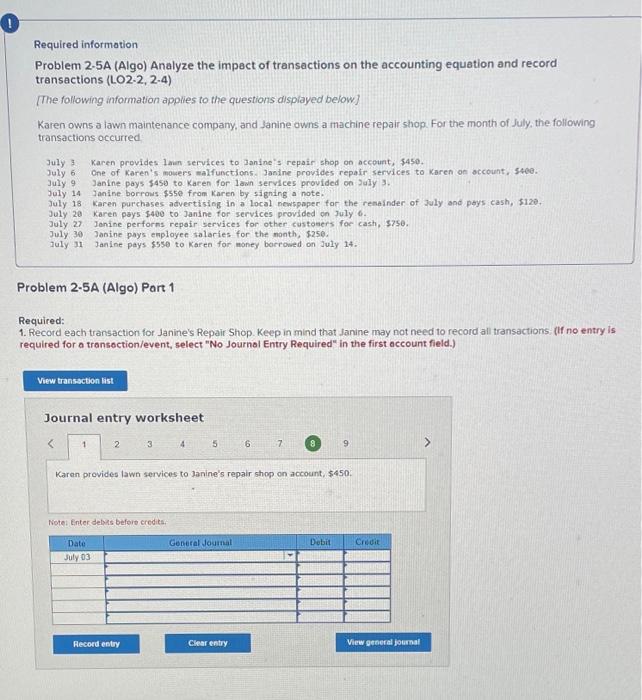

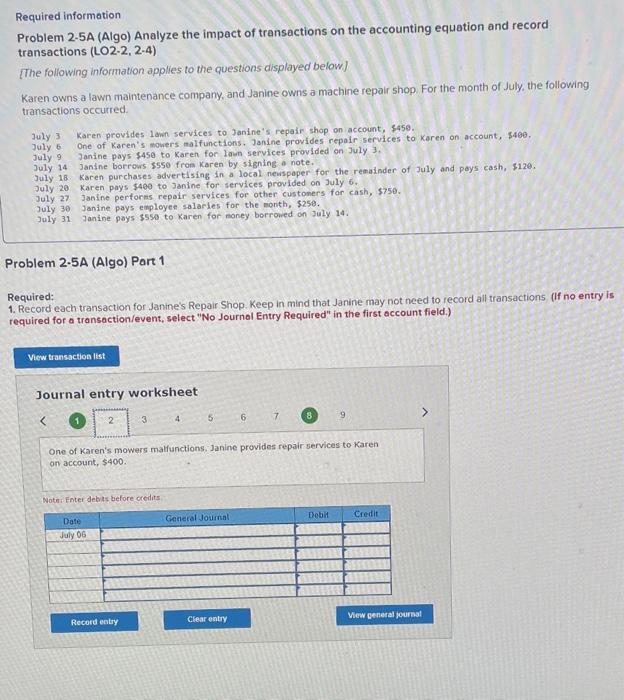

Required information Problem 2.5A (Algo) Analyze the impact of transactions on the accounting equation and record transactions (LO2-2,2-4) [The following information applies to the questions displayed below] Karen owns a lawn maintenance company, and Janine owns a machine repair shop. For the month of July, the following transactions occurred; July 3. Karen provides lain services to Janine's repair shop on account, 5450. July 6 One of Karen's mosers malfunctions. Janine provides repair services to Karen on occount, stee. July 9 Janine pays 5450 to Karen for lawn services provided on July 3. July 14 Janine borrous $550 from Karen by signing a note. July 18 Karen purchases advertising in a local newspoper for the renainder of Joly and pays cash, 512e. July 20 Karen pays $400 to Janine for services provided on July 6. July 27 Jonine perforns repoir services for other custosers for cash, 3750. July 30 Janine pays enplayee salaries for the month, $250. July 11 Janine pays \$5se to Karen for money borrowed on July 14. Problem 2-5A (Algo) Part 1 Required: 1. Record each transaction for Janine's Repair Shop. Keep in mind that Janine may not need to record all transactions; (If no entry is required for a transoction/event, select "No Journol Entry Required" in the first account field.) Journal entry worksheet Karen prevides lawn services to Janine's repair shop on account, $450. Note: Enter debas befort credits. Required information Problem 2-5A (Algo) Analyze the impact of transactions on the accounting equation and record transactions (LO2-2, 2-4) [The following information applies to the questions displayed below] Karen owns a lawn maintenance company, and Janine owns a machine repair shop. For the month of July, the following transactions occurred. July 3 Karen provides lawn services to Janine's repair shop on account, 8459. July 6 One of Karen's movers malfunctions. Janine provides repair services to Karen on account, \$480. July 9 Janine pays $450 to Karen for laun services provlded on July 3 , July 14 Janine borrowis \$550 from Karen by signing a note. July 18. Karen purchases advertlising in a local nevispoper for the remainder of July and poys cash, \$12e. July 20 Karen pays $4e0 to Janine for services provided on July 6 . July 27 Janine perforns repoir services for other custoners for cash, $750. July 30 Janine pays employee salaries for the month, $250. July 31 Janine pays $550 to Karen for noney borrowed on July 14. Problem 2.5A (Algo) Part 1 Required: 1. Record each transaction for Janine's Repair Shop. Keep in mind that Janine may not need to record all transactions (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) Journal entry worksheet One of Karen's mowers malfunctions. Janine provides repair services to Karen on account, $400. Nothi Enter debis before oredirs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts