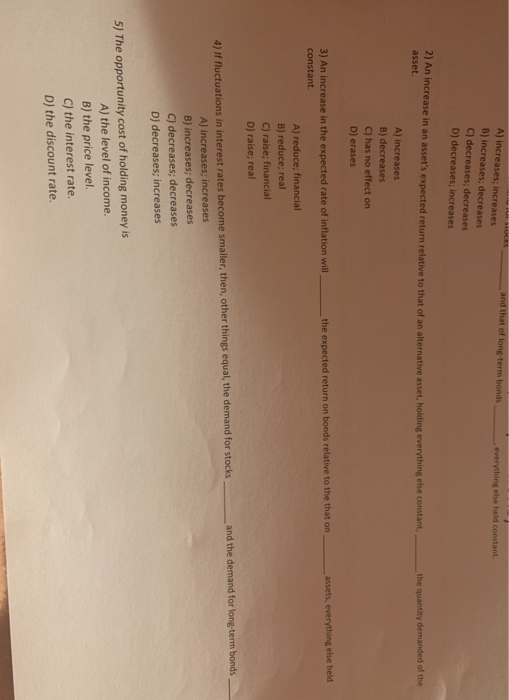

Question: and that of long-term bonds A) increases; increases B) increases; decreases C) decreases; decreases D) decreases; increases ease in an asset's expected return relative to

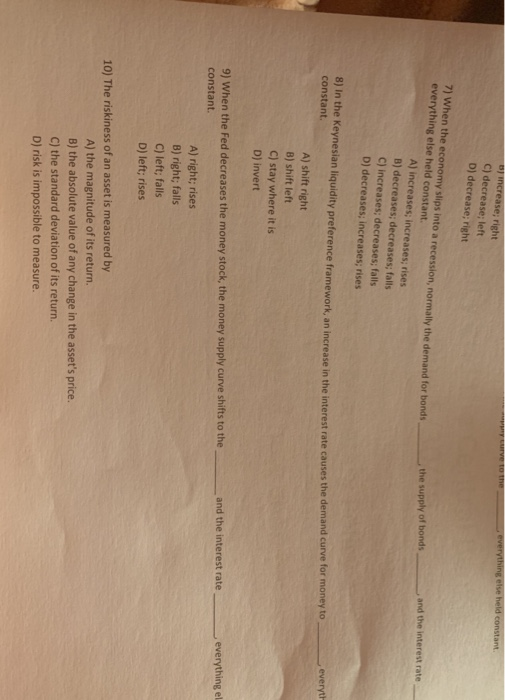

and that of long-term bonds A) increases; increases B) increases; decreases C) decreases; decreases D) decreases; increases ease in an asset's expected return relative to that of an alternative asset, holding everything else constant the quantity demanded of the asset. A) increases B) decreases C) has no effect on D) erases assets, everything else held 3) An increase in the expected rate of inflation willthe expected return on bonds relative to the that constant. A) reduce; financial B) reduce; real C) raise; financial D) raise; real and the demand for long-term bonds 4) If fluctuations in interest rates become smaller, then, other things equal, the demand for stocks A) increases; increases B) increases; decreases C) decreases; decreases D) decreases; increases 5) The opportunity cost of holding money is A) the level of income. B) the price level. C) the interest rate. D) the discount rate. se; right C) decrease; left D) decrease; right 7) When the economy slips into a recession, normally the demand for bonds everything else held constant. and the interest rate , the supply of bonds A) increases; increases; rises B) decreases; decreases; falls C) increases; decreases; falls D) decreases; increases; rises , everyth 8) In the Keynesian liquidity preference framework, an increase in the interest rate causes the demand cu constant. A) shift right B) shift left C) stay where it is D) invert everything el and the interest rate 9) When the Fed decreases the money stock, the money supply curve shifts to the constant. A) right; rises B) right; falls C) left, falls D) left; rises 10) The riskiness of an asset is measured by A) the magnitude of its return. B) the absolute value of any change in the asset's price. C) the standard deviation of its return. D) risk is impossible to measure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts