Question: and the second question is? Required information (The following information applies to the questions displayed below.) On January 1, 2019, Metco Inc. reported 293,000 shares

and the second question is?

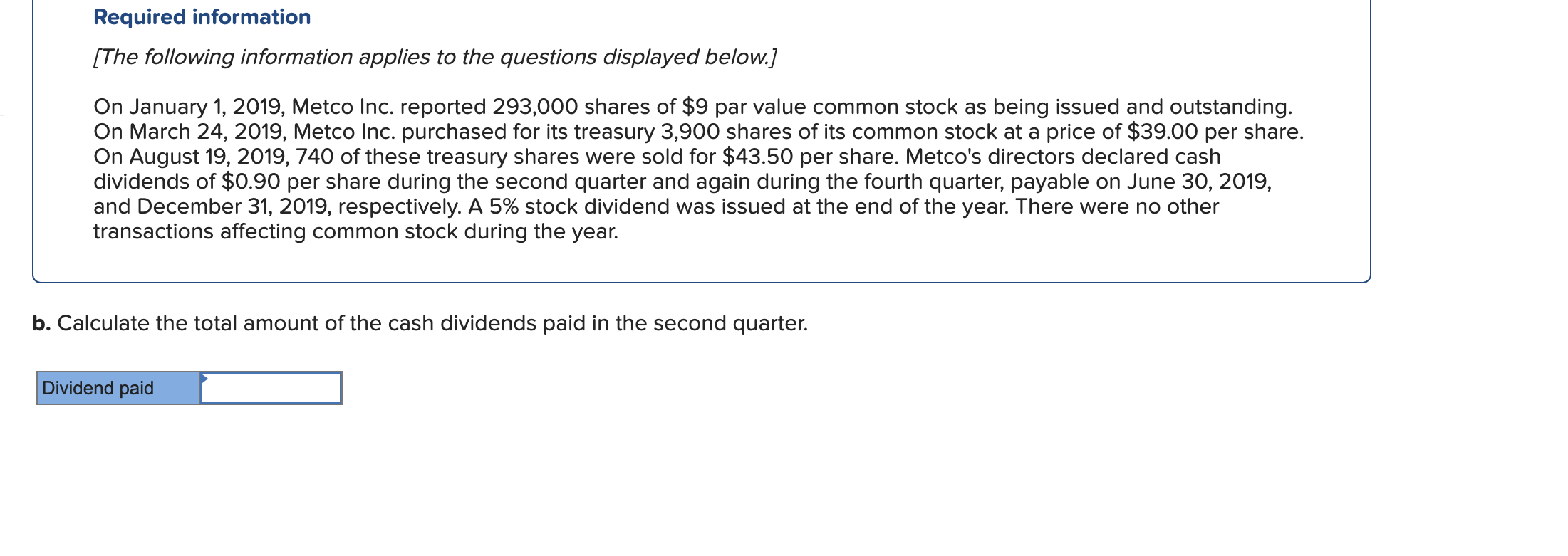

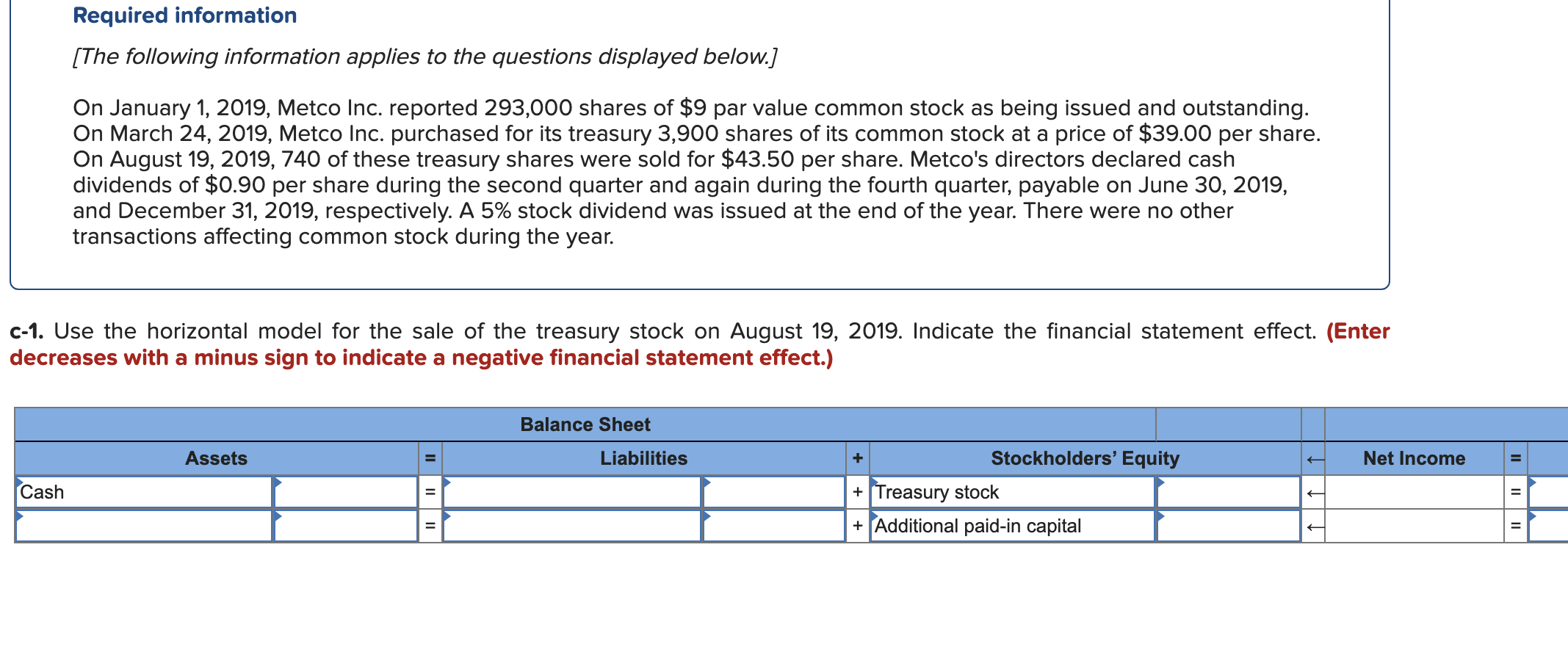

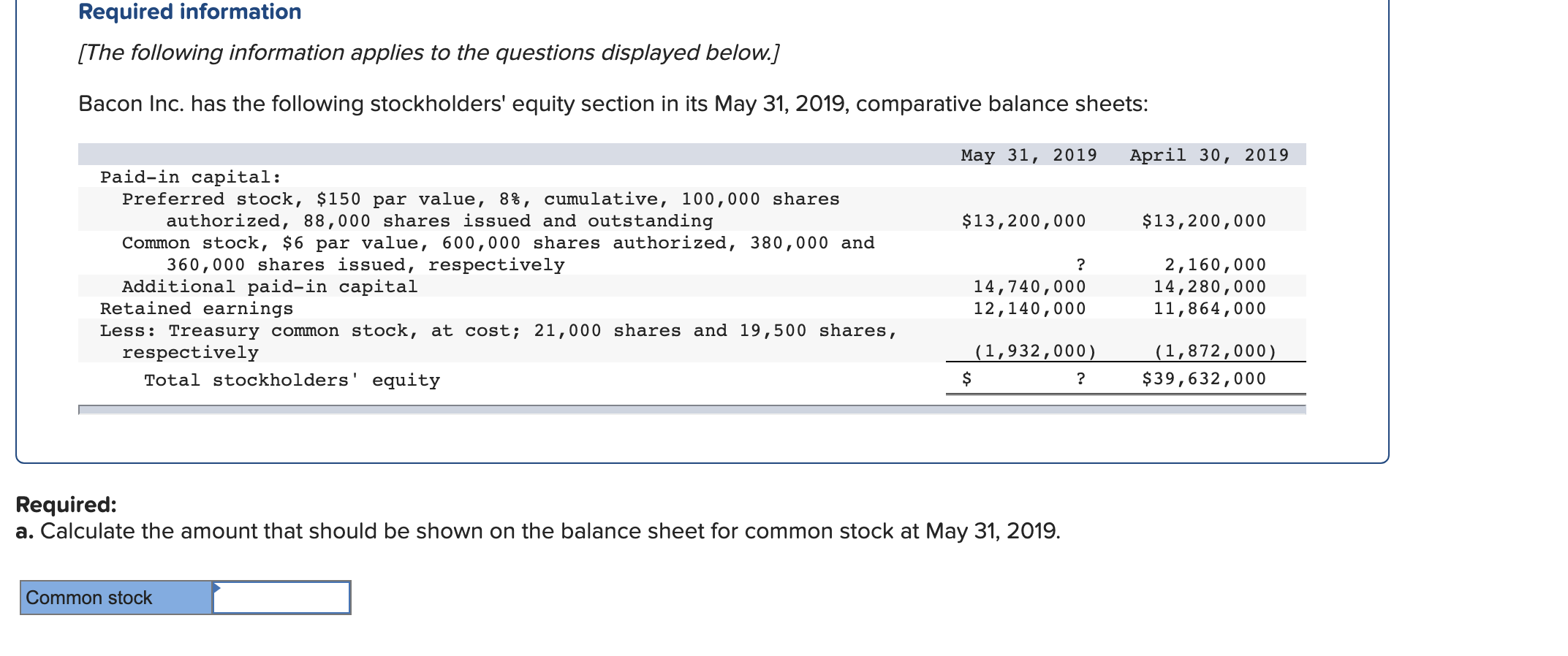

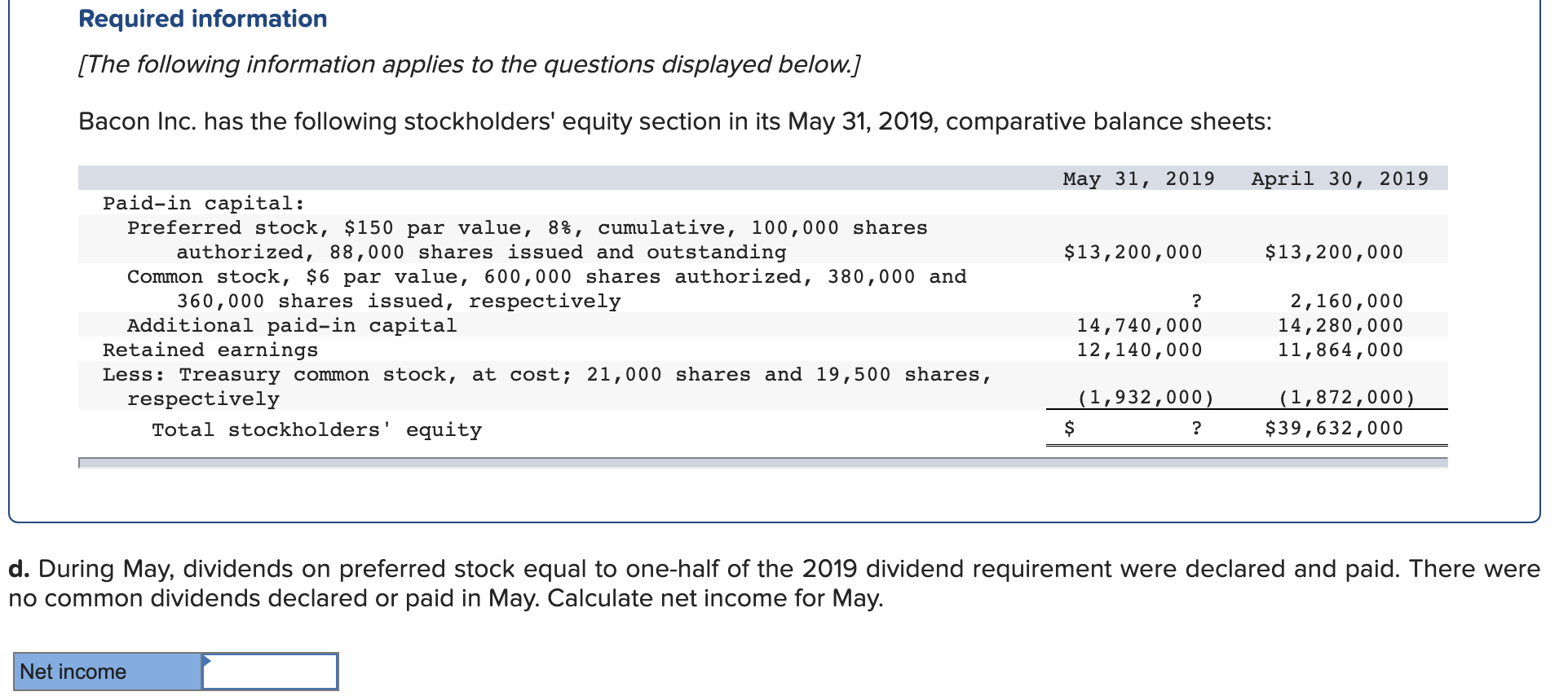

Required information (The following information applies to the questions displayed below.) On January 1, 2019, Metco Inc. reported 293,000 shares of $9 par value common stock as being issued and outstanding. On March 24, 2019, Metco Inc. purchased for its treasury 3,900 shares of its common stock at a price of $39.00 per share. On August 19, 2019, 740 of these treasury shares were sold for $43.50 per share. Metco's directors declared cash dividends of $0.90 per share during the second quarter and again during the fourth quarter, payable on June 30, 2019, and December 31, 2019, respectively. A 5% stock dividend was issued at the end of the year. There were no other transactions affecting common stock during the year. b. Calculate the total amount of the cash dividends paid in the second quarter. Dividend paid Required information [The following information applies to the questions displayed below.] On January 1, 2019, Metco Inc. reported 293,000 shares of $9 par value common stock as being issued and outstanding. On March 24, 2019, Metco Inc. purchased for its treasury 3,900 shares of its common stock at a price of $39.00 per share. On August 19, 2019, 740 of these treasury shares were sold for $43.50 per share. Metco's directors declared cash dividends of $0.90 per share during the second quarter and again during the fourth quarter, payable on June 30, 2019, and December 31, 2019, respectively. A 5% stock dividend was issued at the end of the year. There were no other transactions affecting common stock during the year. C-1. Use the horizontal model for the sale of the treasury stock on August 19, 2019. Indicate the financial statement effect. (Enter decreases with a minus sign to indicate a negative financial statement effect.) Balance Sheet Assets Liabilities Net Income Cash Stockholders' Equity + Treasury stock + Additional paid-in capital = Required information [The following information applies to the questions displayed below.] Bacon Inc. has the following stockholders' equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 $13,200,000 $13,200,000 Paid-in capital: Preferred stock, $150 par value, 8%, cumulative, 100,000 shares authorized, 88,000 shares issued and outstanding Common stock, $6 par value, 600,000 shares authorized, 380,000 and 360,000 shares issued, respectively Additional paid-in capital Retained earnings Less: Treasury common stock, at cost; 21,000 shares and 19,500 shares, respectively Total stockholders' equity ? 14,740,000 12,140,000 2,160,000 14,280,000 11,864,000 (1,932,000) $ ? (1,872,000) $39,632,000 Required: a. Calculate the amount that should be shown on the balance sheet for common stock at May 31, 2019. Common stock Required information (The following information applies to the questions displayed below.) Bacon Inc. has the following stockholders' equity section in its May 31, 2019, comparative balance sheets: May 31, 2019 April 30, 2019 $13,200,000 $13,200,000 Paid-in capital: Preferred stock, $150 par value, 8%, cumulative, 100,000 shares authorized, 88,000 shares issued and outstanding Common stock, $6 par value, 600,000 shares authorized, 380,000 and 360,000 shares issued, respectively Additional paid-in capital Retained earnings Less: Treasury common stock, at cost; 21,000 shares and 19,500 shares, respectively Total stockholders' equity ? 14,740,000 12,140,000 2,160,000 14,280,000 11,864,000 (1,932,000) $ ? (1,872,000) $39,632,000 d. During May, dividends on preferred stock equal to one-half of the 2019 dividend requirement were declared and paid. There were no common dividends declared or paid in May. Calculate net income for May. Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts