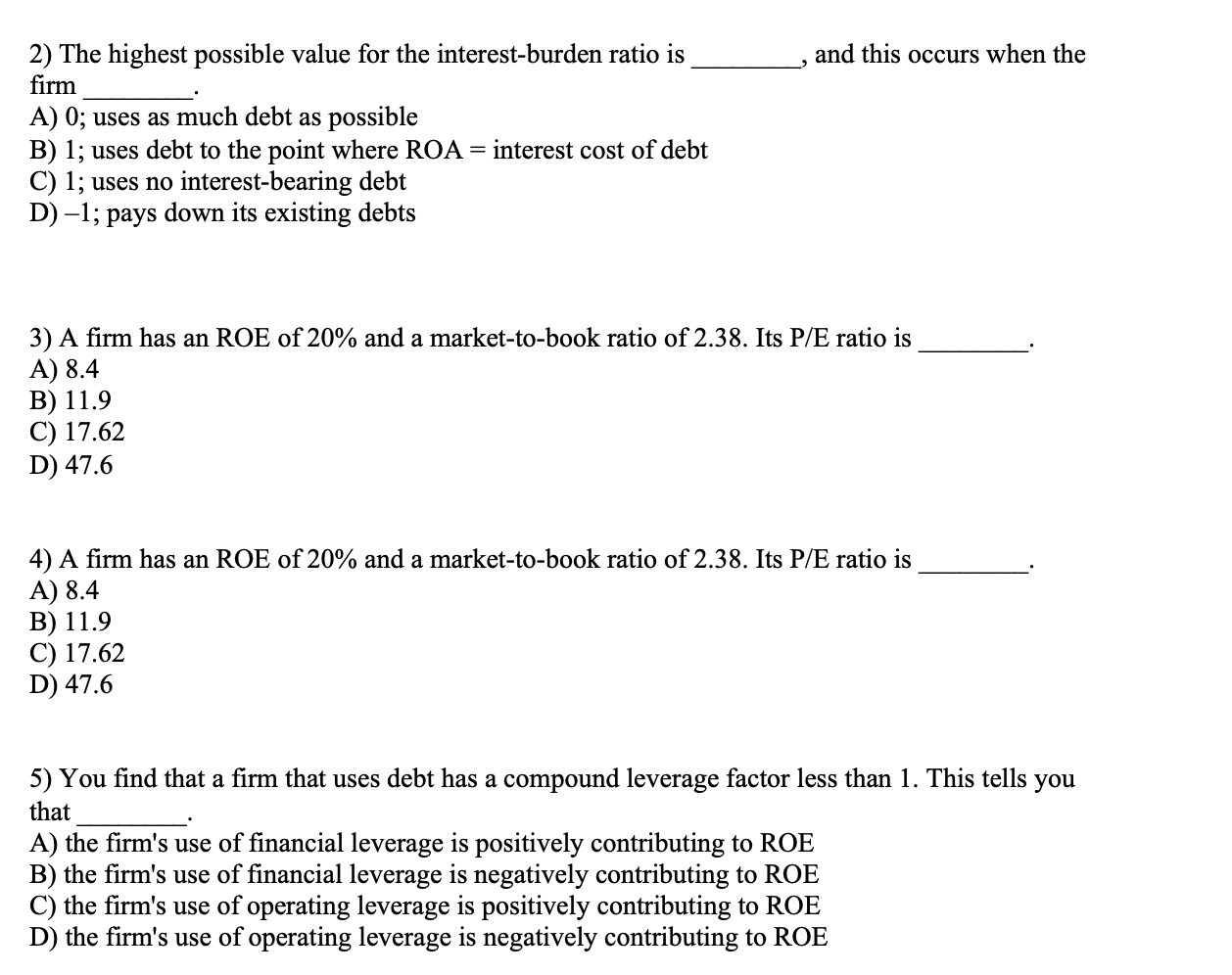

Question: and this occurs when the 2) The highest possible value for the interest-burden ratio is firm A) 0; uses as much debt as possible B)

and this occurs when the 2) The highest possible value for the interest-burden ratio is firm A) 0; uses as much debt as possible B) 1; uses debt to the point where ROA = interest cost of debt C) 1; uses no interest-bearing debt D)-1; pays down its existing debts 3) A firm has an ROE of 20% and a market-to-book ratio of 2.38. Its P/E ratio is A) 8.4 B) 11.9 C) 17.62 D) 47.6 4) A firm has an ROE of 20% and a market-to-book ratio of 2.38. Its P/E ratio is A) 8.4 B) 11.9 C) 17.62 D) 47.6 5) You find that a firm that uses debt has a compound leverage factor less than 1. This tells you that A) the firm's use of financial leverage is positively contributing to ROE B) the firm's use of financial leverage is negatively contributing to ROE C) the firm's use of operating leverage is positively contributing to ROE D) the firm's use of operating leverage is negatively contributing to ROE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts