Question: Angel Consulting is considering 8 projects. Each project has a cost and an associated return. The budget at Angel is $580. Angel would like to

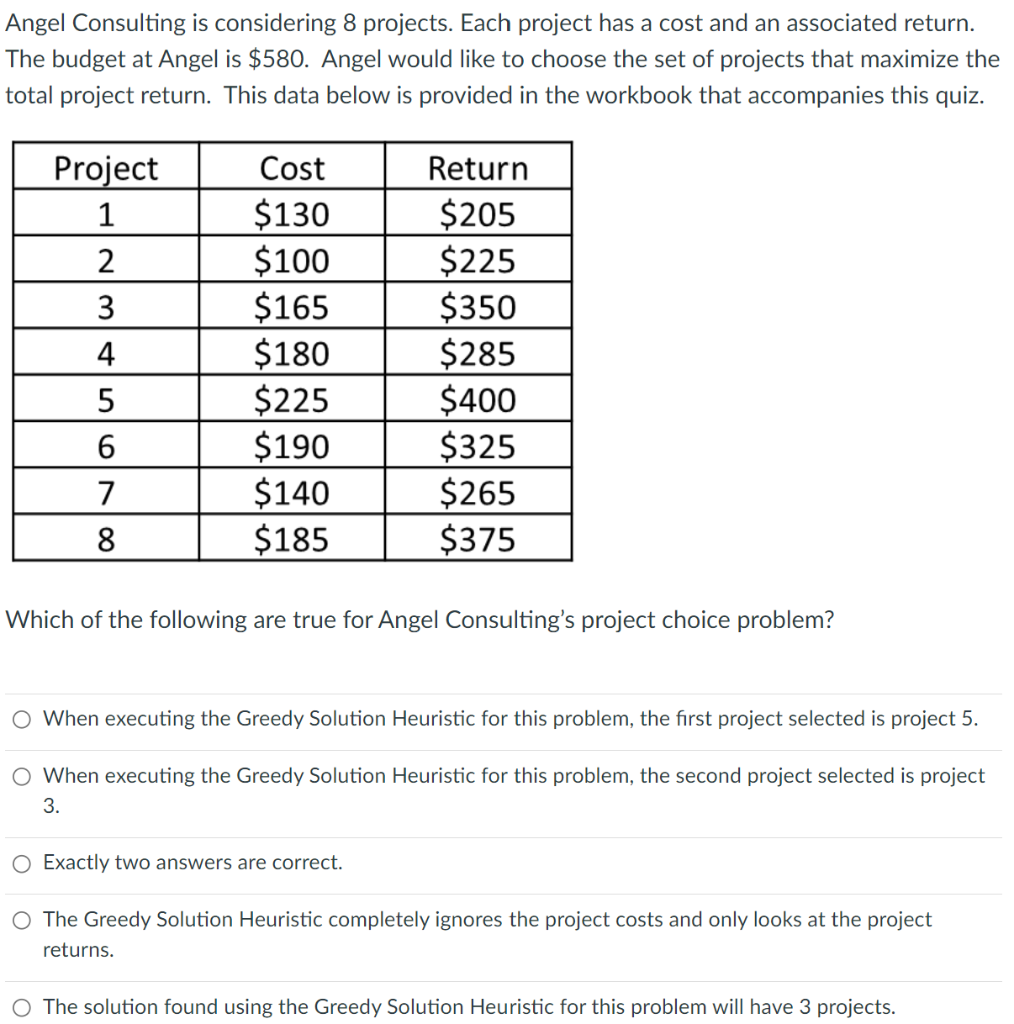

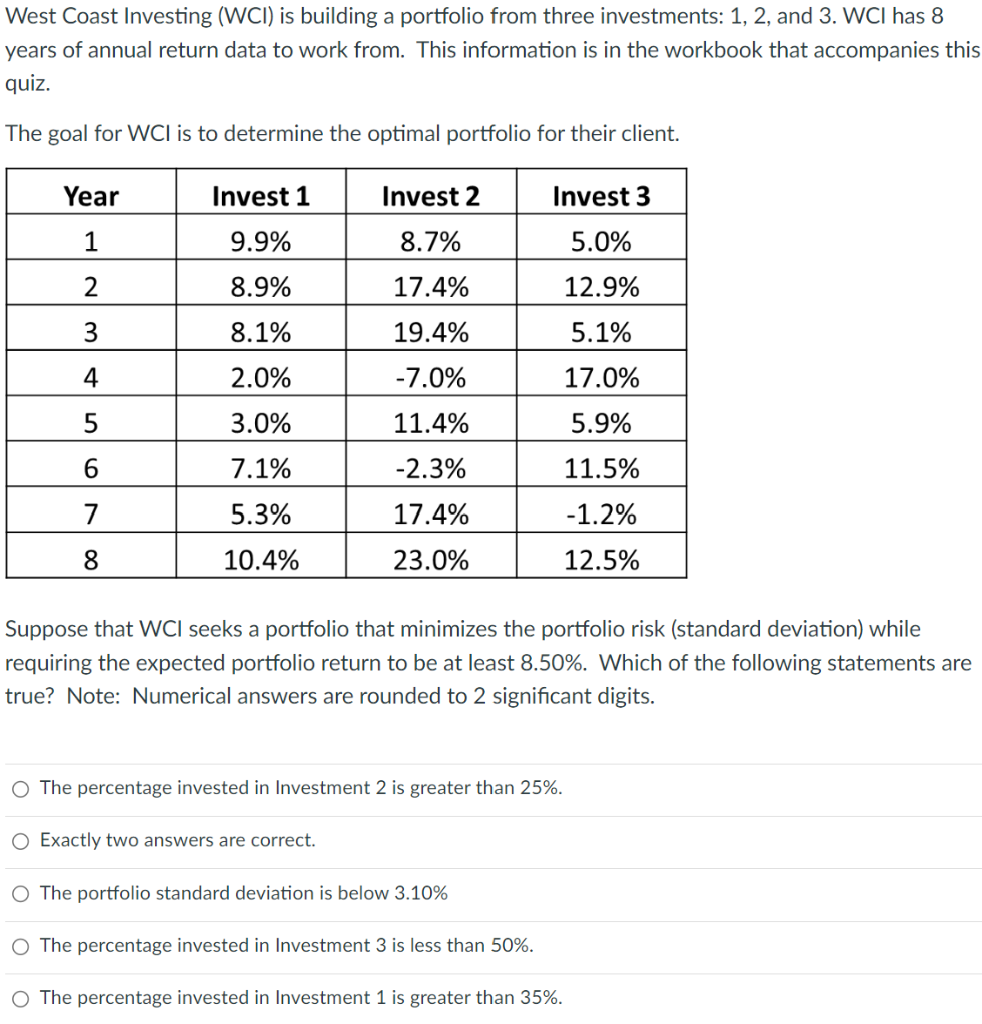

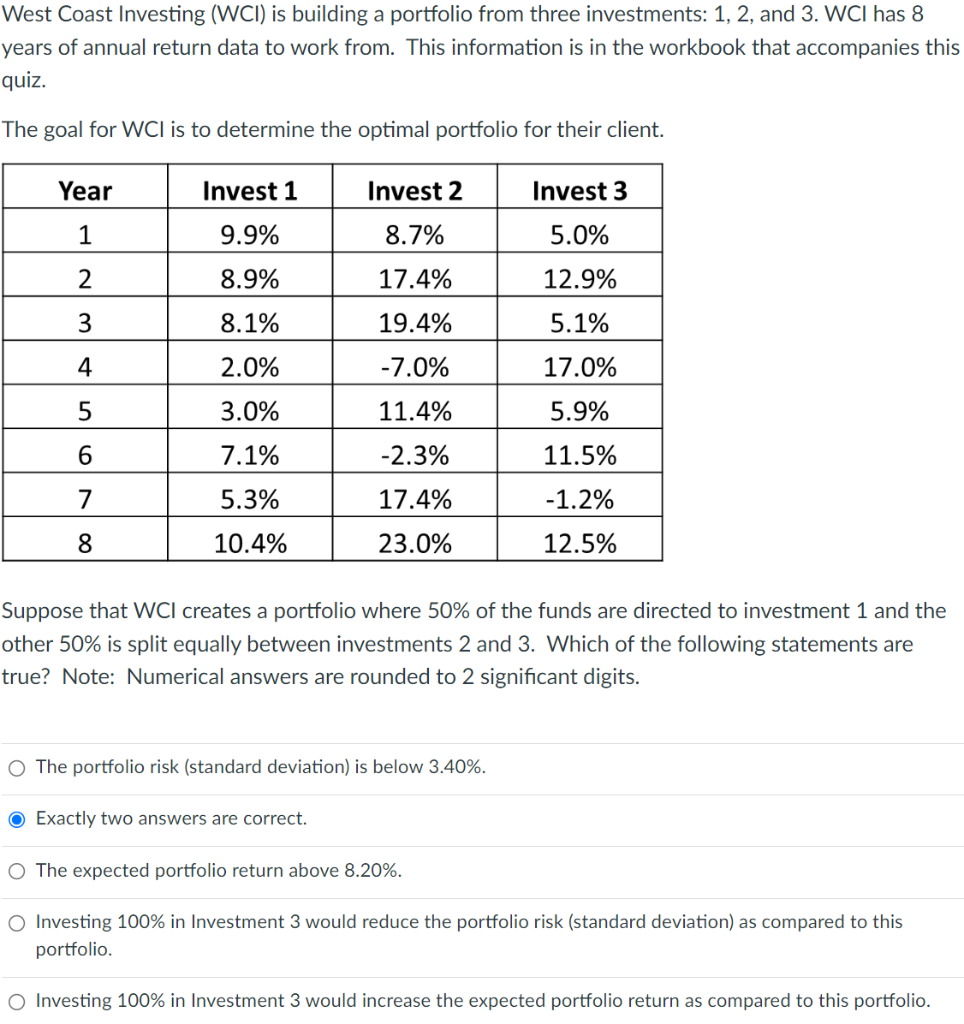

Angel Consulting is considering 8 projects. Each project has a cost and an associated return. The budget at Angel is $580. Angel would like to choose the set of projects that maximize the total project return. This data below is provided in the workbook that accompanies this quiz. Which of the following are true for Angel Consulting's project choice problem? When executing the Greedy Solution Heuristic for this problem, the first project selected is project 5. When executing the Greedy Solution Heuristic for this problem, the second project selected is project 3. Exactly two answers are correct. The Greedy Solution Heuristic completely ignores the project costs and only looks at the project returns. The solution found using the Greedy Solution Heuristic for this problem will have 3 projects. West Coast Investing (WCl) is building a portfolio from three investments: 1,2 , and 3 . WCI has 8 years of annual return data to work from. This information is in the workbook that accompanies this quiz. The goal for WCl is to determine the optimal portfolio for their client. Suppose that WCl seeks a portfolio that minimizes the portfolio risk (standard deviation) while requiring the expected portfolio return to be at least 8.50%. Which of the following statements are true? Note: Numerical answers are rounded to 2 significant digits. The percentage invested in Investment 2 is greater than 25%. Exactly two answers are correct. The portfolio standard deviation is below 3.10% The percentage invested in Investment 3 is less than 50\%. The percentage invested in Investment 1 is greater than 35%. West Coast Investing (WCl) is building a portfolio from three investments: 1,2 , and 3.WCl has 8 years of annual return data to work from. This information is in the workbook that accompanies this quiz. The goal for WCl is to determine the optimal portfolio for their client. Suppose that WCl creates a portfolio where 50% of the funds are directed to investment 1 and the other 50% is split equally between investments 2 and 3 . Which of the following statements are true? Note: Numerical answers are rounded to 2 significant digits. The portfolio risk (standard deviation) is below 3.40%. Exactly two answers are correct. The expected portfolio return above 8.20%. Investing 100% in Investment 3 would reduce the portfolio risk (standard deviation) as compared to this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts