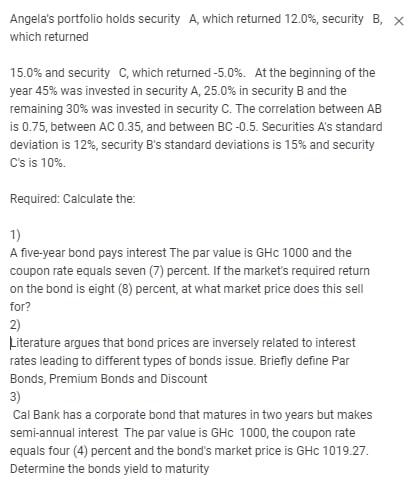

Question: Angela's portfolio holds security A, which returned 12.0%, security B, X which returned 15.0% and security C, which returned -5.0%. At the beginning of

Angela's portfolio holds security A, which returned 12.0%, security B, X which returned 15.0% and security C, which returned -5.0%. At the beginning of the year 45% was invested in security A, 25.0% in security B and the remaining 30% was invested in security C. The correlation between AB is 0.75, between AC 0.35, and between BC -0.5. Securities A's standard deviation is 12%, security B's standard deviations is 15% and security C's is 10%. Required: Calculate the: 1) A five-year bond pays interest The par value is GHC 1000 and the coupon rate equals seven (7) percent. If the market's required return on the bond is eight (8) percent, at what market price does this sell for? 2) Literature argues that bond prices are inversely related to interest rates leading to different types of bonds issue. Briefly define Par Bonds, Premium Bonds and Discount 3) Cal Bank has a corporate bond that matures in two years but makes semi-annual interest The par value is GHC 1000, the coupon rate equals four (4) percent and the bond's market price is GHC 1019.27. Determine the bonds yield to maturity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts