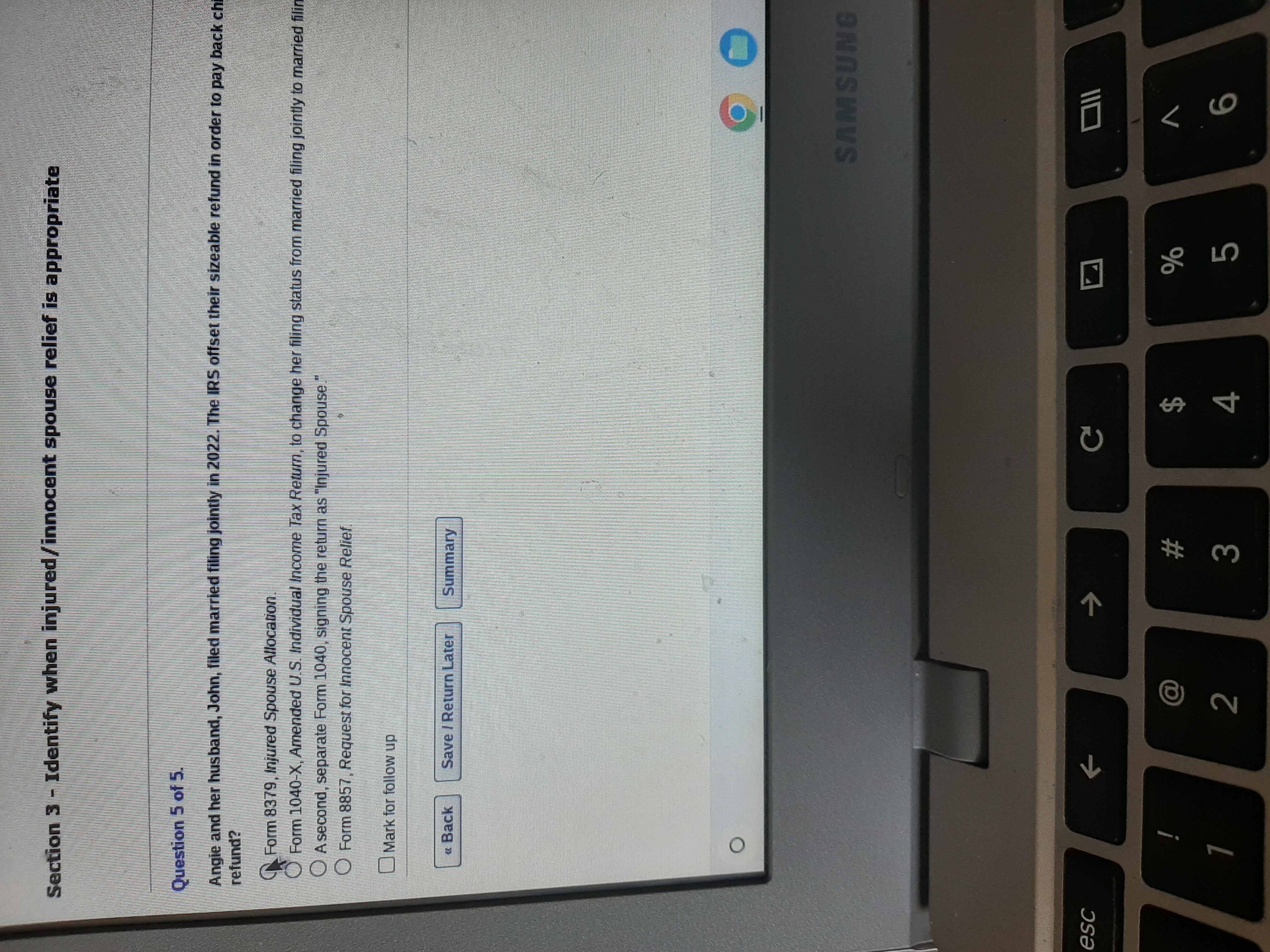

Question: angie and her husband john Section 3 - Identify when injured / innocent spouse relief is appropriate Question 5 of 5 . Angie and her

angie and her husband john Section Identify when injuredinnocent spouse relief is appropriate

Question of

Angie and her husband, John, filed married filing jointly in The IRS offset their sizeable refund in order to pay back ch refund?

Form Injured Spouse Allocation.

Form X Amended US Individual Income Tax Return, to change her filing status from married filing jointly to married filin

A second, separate Form signing the return as "Injured Spouse."

Form Request for Innocent Spouse Relief.

Mark for follow up

Back

Save Return Later

Summary

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock