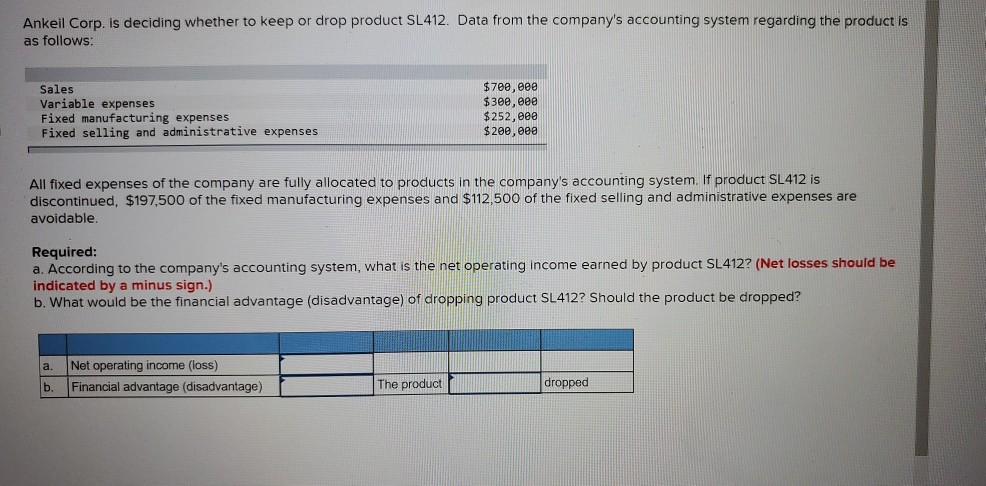

Question: Ankeil Corp. is deciding whether to keep or drop product SL412. Data from the company's accounting system regarding the product is as follows: Sales Variable

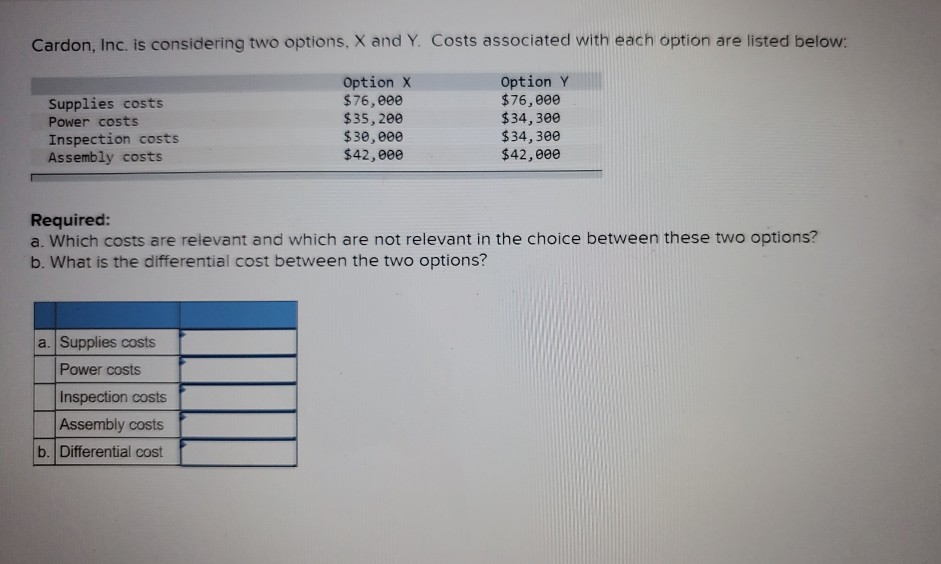

Ankeil Corp. is deciding whether to keep or drop product SL412. Data from the company's accounting system regarding the product is as follows: Sales Variable expenses Fixed manufacturing expenses Fixed selling and administrative expenses $700, eee $300, eee $252,000 $200, eee All fixed expenses of the company are fully allocated to products in the company's accounting system. If product SL412 is discontinued, $197,500 of the fixed manufacturing expenses and $112.500 of the fixed selling and administrative expenses are avoidable. Required: a. According to the company's accounting system, what is the net operating income earned by product SL412? (Net losses should be indicated by a minus sign.) b. What would be the financial advantage (disadvantage) of dropping product SL412? Should the product be dropped? a. b. Net operating income (loss) Financial advantage (disadvantage) The product dropped Cardon, Inc. is considering two options, X and Y Costs associated with each option are listed below: Supplies costs Power costs Inspection costs Assembly costs Option X $76,000 $35,200 $30,000 $42,000 Option Y $76,000 $34,300 $34,300 $42,000 Required: a. Which costs are relevant and which are not relevant in the choice between these two options? b. What is the differential cost between the two options? a. Supplies costs Power costs Inspection costs Assembly costs b. Differential cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts