Question: anlearn - Pinal Exam Kaplanitearn - Final Exam 9 . kaplanlearn.com / education / dashboard / ndex / Ela 3 2 6 7 7 bbdBea

anlearn Pinal Exam

Kaplanitearn Final Exam

kaplanlearn.comeducationdashboardndexElabbdBeadcaeaexam

November Tax Planning

My Dultioner

estion of

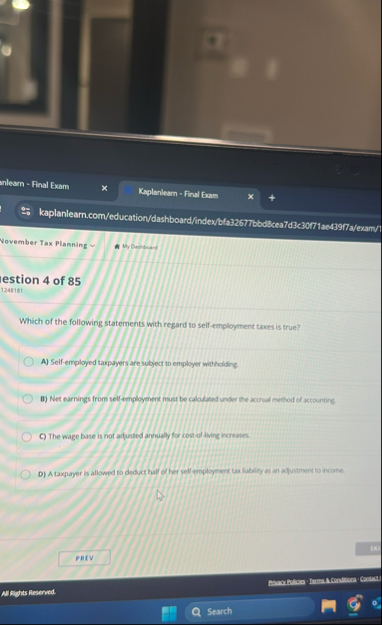

Which of the following statements with regard to selfemployment taxes is true?

A Selfemployed taxpayers are subject to employer witholding

B Net earnings from selfemployment mast be calculated under the accoul method of accouring:

C The wage base is not adjusted annualy for contol tiaing noreases.

D A taxpayer is allowed to deduct half of her self employers us hibility as an aquisment to income.

Glayarisaplamangeriey

contain

Al Rights Rearned:

Search

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock