Question: Anna is a 2 1 - year - old full - time college student ( she plans on returning home at the end of the

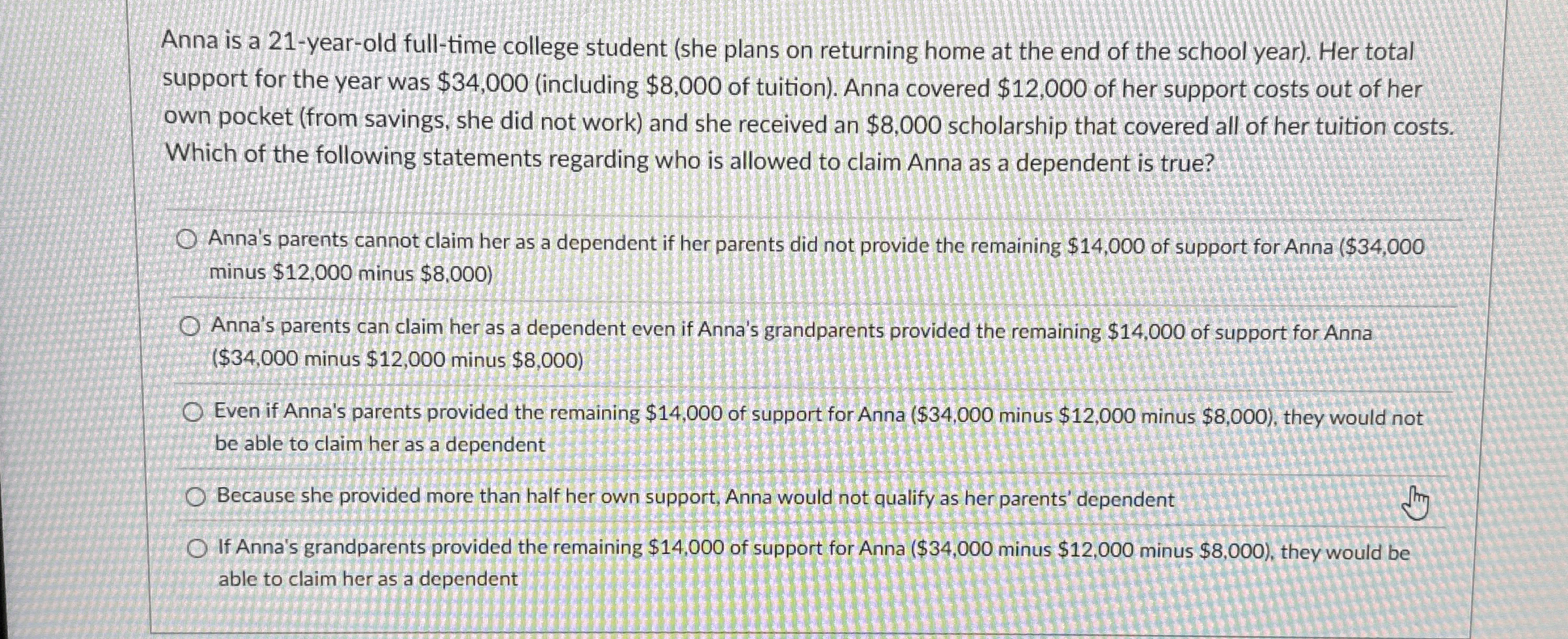

Anna is a yearold fulltime college student she plans on returning home at the end of the school year Her total support for the year was $including $ of tuition Anna covered $ of her support costs out of her own pocket from savings, she did not work and she received an $ scholarship that covered all of her tuition costs. Which of the following statements regarding who is allowed to claim Anna as a dependent is true?

Anna's parents cannot claim her as a dependent if her parents did not provide the remaining $ of support for Anna $ minus $ minus $

Anna's parents can claim her as a dependent even if Anna's grandparents provided the remaining $ of support for Anna minus $ minus $

Even if Anna's parents provided the remaining $ of support for Anna $ minus $ minus $ they would not be able to claim her as a dependent

Because she provided more than half her own support, Anna would not qualify as her parents' dependent

If Anna's grandparents provided the remaining $ of support for Anna $ minus $ minus $ they would be able to claim her as a dependent

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock