Question: ANNEXURE I: FORMATIVE ASSESSMENT 2 QUESTION 3 (4 marks) Bright Bricks (Pty) Ltd ('Bright Bricks') is a resident of South Africa. Bright Bricks supplies bricks

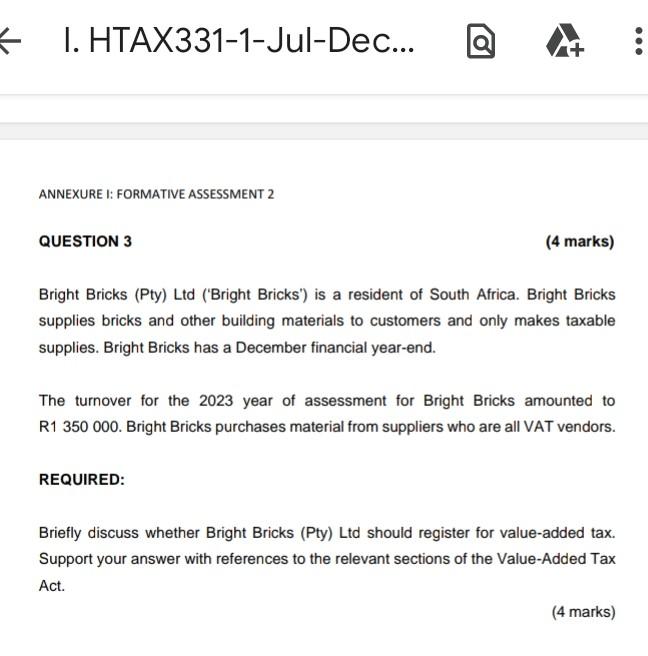

ANNEXURE I: FORMATIVE ASSESSMENT 2 QUESTION 3 (4 marks) Bright Bricks (Pty) Ltd ('Bright Bricks') is a resident of South Africa. Bright Bricks supplies bricks and other building materials to customers and only makes taxable supplies. Bright Bricks has a December financial year-end. The turnover for the 2023 year of assessment for Bright Bricks amounted to R1 350 000. Bright Bricks purchases material from suppliers who are all VAT vendors. REQUIRED: Briefly discuss whether Bright Bricks (Pty) Ltd should register for value-added tax. Support your answer with references to the relevant sections of the Value-Added Tax Act

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock