Question: ANNUITIES & PORTFOLIO IMMUNIZATION (IMMUNIZE) PLEASE ANSWER A & B, need answer of part A to answer Part B QUESTION 7 (a) A pension fund

ANNUITIES & PORTFOLIO IMMUNIZATION (IMMUNIZE)

PLEASE ANSWER A & B, need answer of part A to answer Part B

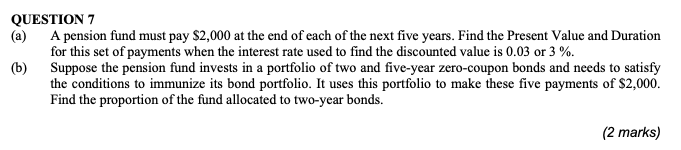

QUESTION 7 (a) A pension fund must pay $2,000 at the end of each of the next five years. Find the Present Value and Duration for this set of payments when the interest rate used to find the discounted value is 0.03 or 3 %. (b) Suppose the pension fund invests in a portfolio of two and five-year zero-coupon bonds and needs to satisfy the conditions to immunize its bond portfolio. It uses this portfolio to make these five payments of $2,000. Find the proportion of the fund allocated to two-year bonds. (2 marks) QUESTION 7 (a) A pension fund must pay $2,000 at the end of each of the next five years. Find the Present Value and Duration for this set of payments when the interest rate used to find the discounted value is 0.03 or 3 %. (b) Suppose the pension fund invests in a portfolio of two and five-year zero-coupon bonds and needs to satisfy the conditions to immunize its bond portfolio. It uses this portfolio to make these five payments of $2,000. Find the proportion of the fund allocated to two-year bonds. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts