Question: Another 4 multiple chioce question During 20X7, sigma Company earned service revenues amounting to $700,000, of which $630,000 was collected in cash; the balance will

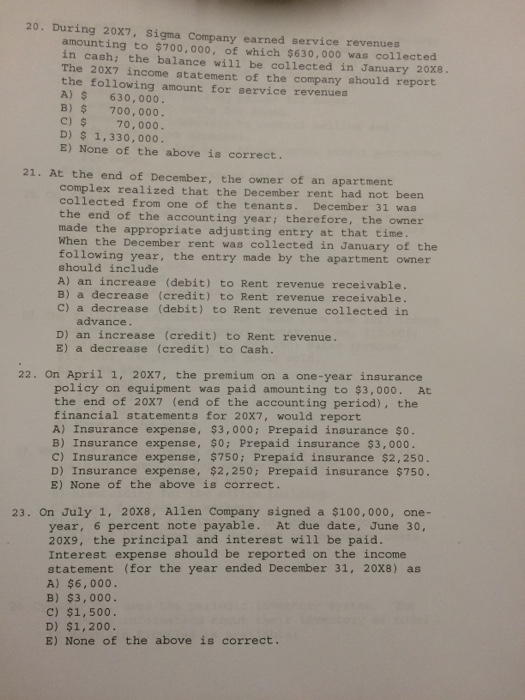

During 20X7, sigma Company earned service revenues amounting to $700,000, of which $630,000 was collected in cash; the balance will be collected in January 20X8. The 20 X7 income statement of the company should report the following amount for service revenues At the end of December, the owner of an apartment complex realized that the December rent had not been collected from one of the tenants. December 31 was the end of the accounting year; therefore, the owner made the appropriate adjusting entry at that time. When the December rent was collected in January of the following year, the entry made by the apartment owner should include an increase (debit) to Rent revenue receivable. a decrease (credit) to Rent revenue receivable. a decrease (debit) to Rent revenue collected in advance. an increase (credit) to Rent revenue. a decrease (credit) to Cash. On April 1, 20X7, the premium on a one-year insurance policy on equipment was paid amounting to $3,000. At the end of 20X7 (end of the accounting period), the financial statements for 20X7, would report Insurance expense, $3,000; Prepaid insurance $0. Insurance expense, $0; Prepaid insurance $3,000. Insurance expense, $750; Prepaid insurance $2,250. Insurance expense, $2,250; Prepaid insurance $750. None of the above is correct. On July 1, 20X8, Allen Company signed a $100,000, one- year, 6 percent note payable. At due date, June 30, 20X9, the principal and interest will be paid. Interest expense should be reported on the income statement (for the year ended December 31, 20X8) as

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts