Question: another fiance question :) a stwp by atep would really help. i cant seem to figure it out thank you (Cerporate ineome tax) Last year

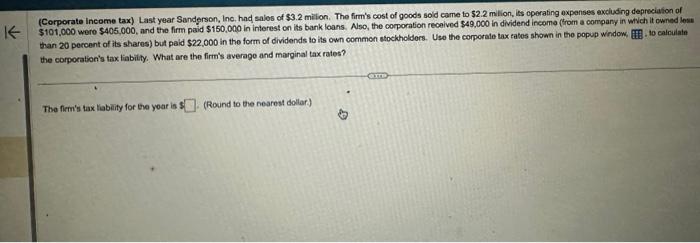

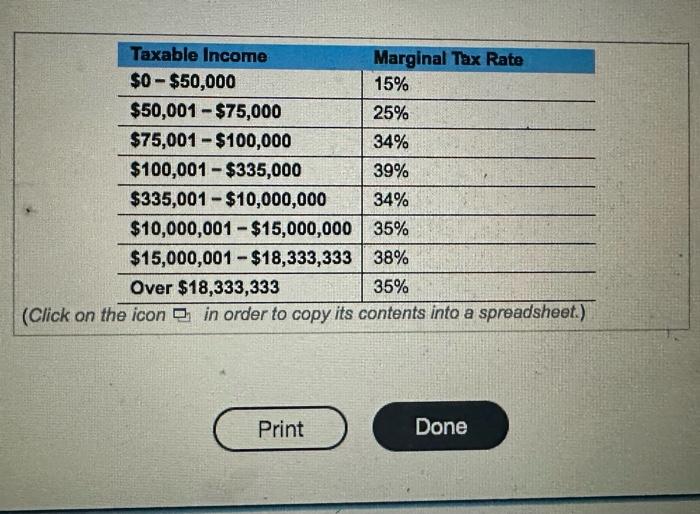

(Cerporate ineome tax) Last year Sanderson, Inc. had salos of $3.2 milion. The firm's cost of goods sold came to $2.2million, its cperating expenses excluding depreciation of $101,000 wero $405,000, and the firm paid $150,000 in interest on its bark loans. Nso, the corporation received $49,000 in dividend income (trom a company in wivch it owned lese than 20 percent of its shares) but paid $22,000 in the form of dividends to its own commen stocktholders. Use the corporate tax eates shown in the popup window 10 calculate the corpocation's tax liabiity. What are the firm's average and marginal tax rates? The firm's tax liability for the yoar is 1 (Round to the nearest dollar) \begin{tabular}{|l|l|} \hline Taxable Income & Marginal Tax Rate \\ \hline $0$50,000 & 15% \\ \hline $50,001$75,000 & 25% \\ \hline $75,001$100,000 & 34% \\ \hline $100,001$335,000 & 39% \\ \hline $335,001$10,000,000 & 34% \\ \hline $10,000,001$15,000,000 & 35% \\ \hline $15,000,001$18,333,333 & 38% \\ \hline Over $18,333,33 & 35% \\ \hline \end{tabular} (Click on the icon in order to copy its contents into a spreadsheet.) Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts