Question: ANPV approach Porter & Sons is evaluating three different machines to be used in its workshop to polish marble. All three of the machines are

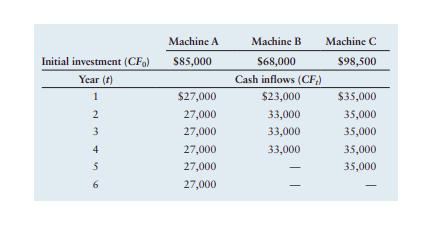

ANPV approach Porter & Sons is evaluating three different machines to be used in its workshop to polish marble. All three of the machines are equally risky. The cost of capital of Porter & Sons is 15%. The initial investment and annual cash inflows over the life of each machine are shown in the following table.

a. Calculate the net present value (NPV) for each of the machines, and rank the three on the basis of the NPV in order of acceptance.

a. Calculate the net present value (NPV) for each of the machines, and rank the three on the basis of the NPV in order of acceptance.

b. Calculate the annualized net present value (ANPV) for each of the machines, and rank the three on the basis of the ANPV in order of acceptance.

c. Based on your calculations in parts a and b, which machine should Porter & Sons invest in? Explain your choice.

Initial investment (CF) Year (1) 1 2 3 4 5 6 Machine A $85,000 $27,000 27,000 27,000 27,000 27,000 27,000 Machine B $68,000 Cash inflows (CF) $23,000 33,000 33,000 33,000 - Machine C $98,500 $35,000 35,000 35,000 35,000 35,000

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

a NPV Machine A 1718103 Machine B 1751863 Machine C 1882543 b ANPV Machine A 453986 Machine B 613617 ... View full answer

Get step-by-step solutions from verified subject matter experts