Question: ans all A firm is considering two MUTUALLY EXCLUSIVE projects with the cash flows shown below. What is the crossover rate of return for these

ans all

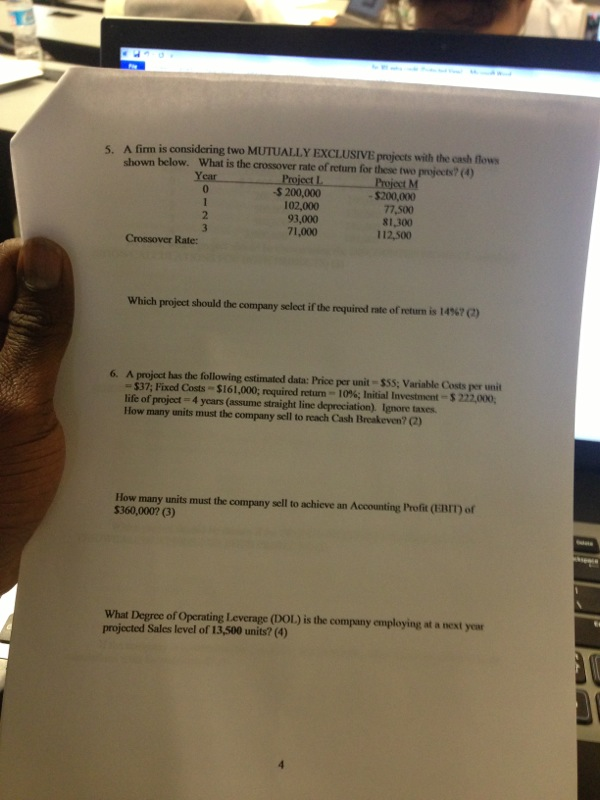

A firm is considering two MUTUALLY EXCLUSIVE projects with the cash flows shown below. What is the crossover rate of return for these two projects?(4) Crossover Rate: Which project should the company select if the required rate of return is 14%? (2) A project has the following estimated data: Price per unit = $55; Variable Costs per unit = $37; Fixed Costs = $161,000; required return = 10%; Initial Investment = $ 222,000; life of project = 4 years (assume straight line depreciation). Ignore taxes. How many units must the company sell to reach Cash Breakeven? (2) How many units must the company sell to achieve an Accounting Profit (EBIT) of $360,000? (3) What degree of Operating Leverage (DOL) is the company employing at a next year projected Sales level of 13,500 units?(4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts