Question: ans all please a zero coupon bond with a face value of $1,000 and a maturity of 25 on the bond remains unchanged, what will

ans all please

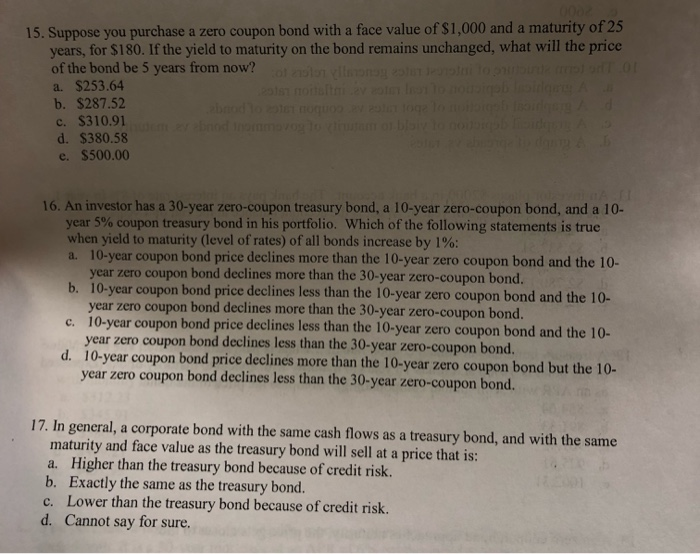

ans all pleasea zero coupon bond with a face value of $1,000 and a maturity of 25 on the bond remains unchanged, what will the price 15. Suppose you purchase years, for $180. If the yield to maturity of the bond be 5 years from now? a. $253.64 b. $287.52 c. $310.91 nem arebnod nommozog to uam o blov to nodbigb od d. $380.58 e. $500.00 2ol nottsftv ot e To nousiqab lroidgre A bod to ot oguoo oga lo moiloiesh odg Ad A 16. An investor has a 30-year zero-coupon treasury bond, a 10-year zero-coupon bond, and a 10- year 5% coupon treasury bond in his portfolio. Which of the following statements is true when yield to maturity (level of rates) of all bonds increase by 1%: a. 10-year coupon bond price declines more than the 10-year zero coupon bond and the 10- year zero coupon bond declines more than the 30-year zero-coupon bond. b. 10-year coupon bond price declines less than the 10-year year zero coupon bond declines more than the 30-year 10-year coupon bond price declines less than the 10-year zero coupon bond and the 10- year zero coupon bond declines less than the 30-year zero-coupon bond. d. 10-year coupon bond price declines more than the 10-year year zero coupon bond declines less than the 30-year zero-coupon bond. zero coupon bond and the 10- zero-coupon bond. C. zero coupon bond but the 10- 17. In general, a corporate bond with the same cash flows as a treasury bond, and with the same maturity and face value as the treasury bond will sell at a price that is: Higher than the treasury bond because of credit risk. b. Exactly the same as the treasury bond. c. Lower than the treasury bond because of credit risk. d. Cannot say for sure. a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts