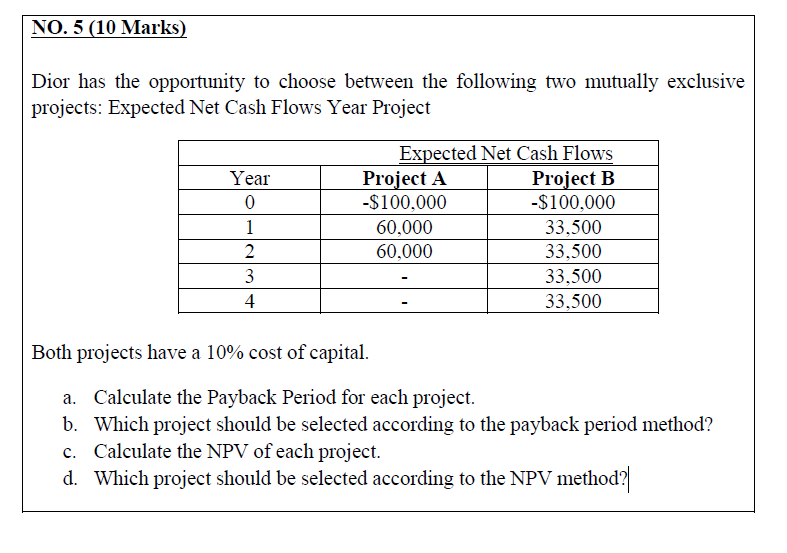

Question: Ans full and fast respond please. Thumbs up. NO. 5 (10 Marks) Dior has the opportunity to choose between the following two mutually exclusive projects:

Ans full and fast respond please. Thumbs up.

NO. 5 (10 Marks) Dior has the opportunity to choose between the following two mutually exclusive projects: Expected Net Cash Flows Year Project Year 0 1 2 3 4 Expected Net Cash Flows Project A Project B -$100,000 -$100,000 60,000 33,500 60,000 33,500 33,500 33,500 Both projects have a 10% cost of capital. a. Calculate the Payback Period for each project. b. Which project should be selected according to the payback period method? c. Calculate the NPV of each project. d. Which project should be selected according to the NPV method

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock