Question: ANS WITH FULLY EXPLANATION Question 8 Not complete Marked out of 1.00 V Flag question Consider a market in which the demand curve is given

ANS WITH FULLY EXPLANATION

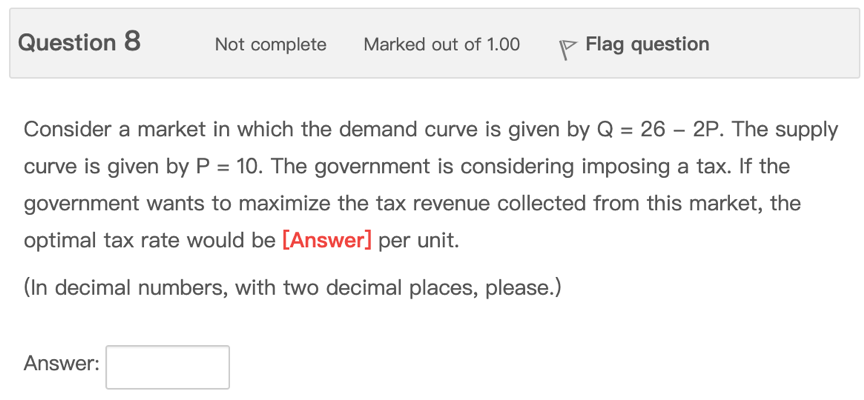

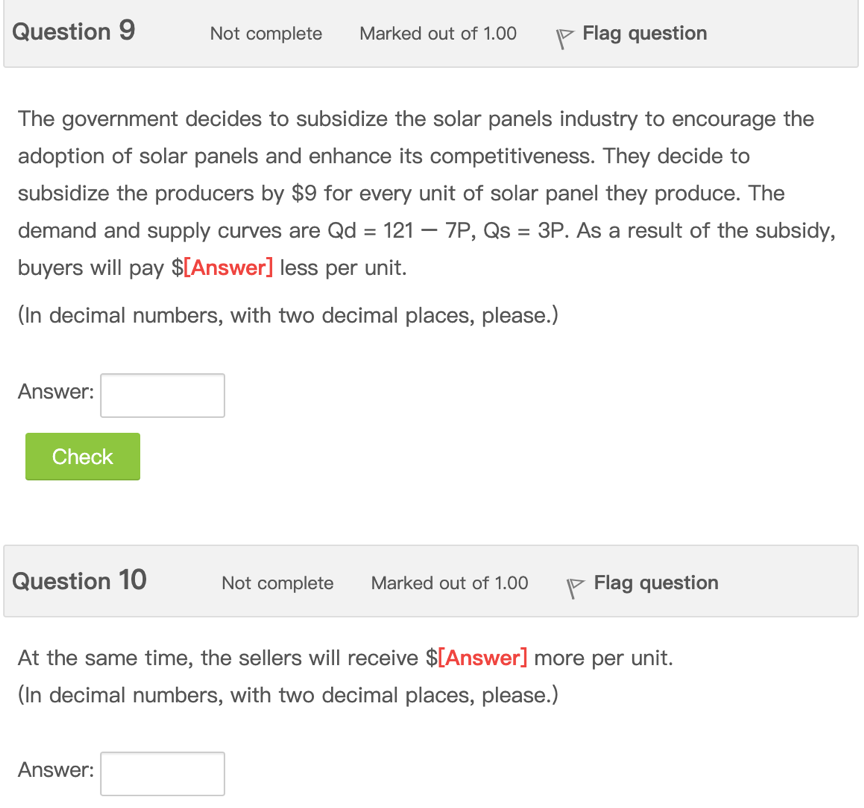

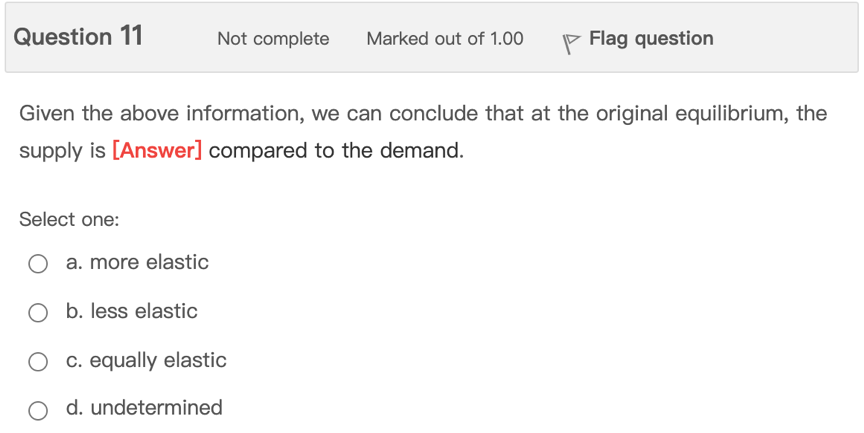

Question 8 Not complete Marked out of 1.00 V Flag question Consider a market in which the demand curve is given by Q = 26 2P. The supply curve is given by P = 10. The government is considering imposing a tax. If the government wants to maximize the tax revenue collected from this market, the optimal tax rate would be [Answer] per unit. (In decimal numbers, with two decimal places, please.) Answer: ' Question 9 Not complete Marked out of 1.00 V Flag question The government decides to subsidize the solar panels industry to encourage the adoption of solar panels and enhance its competitiveness. They decide to subsidize the producers by $9 for every unit of solar panel they produce. The demand and supply curves are Qd = 121 7P, GS = 3P. As a result of the subsidy, buyers will pay $[Answer] less per unit. (In decimal numbers, with two decimal places, please.) Answer: ' I Question 10 Not complete Marked out of 1.00 V Flag question At the same time, the sellers will receive $[Answer] more per unit. (In decimal numbers, with two decimal places, please.) Answer: Question 11 Not complete Marked out of 1.00 '7 Flag question Given the above information, we can conclude that at the original equilibrium, the supply is [Answer] compared to the demand. Select one: Q a. more elastic O b. less elastic O 0. equally elastic Q d. undetermined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts