Question: answe fast plaz Important answer fast please Based on the information below, please answer Question 11 and Question 12: Company C has one note receivable

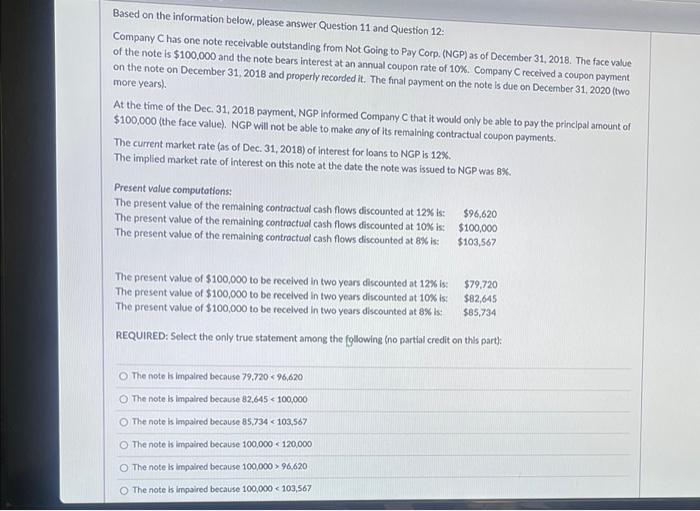

Based on the information below, please answer Question 11 and Question 12: Company C has one note receivable outstanding from Not Going to Pay Corp. (NGP) as of December 31, 2018. The face value of the note is $100,000 and the note bears interest at an annual coupon rate of 10%. Company received a coupon payment on the note on December 31, 2018 and properly recorded it. The final payment on the note is due on December 31, 2020 (two more years). At the time of the Dec 31, 2018 payment, NGP informed Company C that it would only be able to pay the principal amount of $100,000 (the face value). NGP will not be able to make any of its remaining contractual coupon payments. The current market rate (as of Dec 31, 2018) of interest for loans to NGP is 12%. The implied market rate of interest on this note at the date the note was issued to NGP was 8%. Present value computations: The present value of the remaining contractual cash flows discounted at 12%: $96,620 The present value of the remaining contractual cash flows discounted at 10% is: $100,000 The present value of the remaining contractual cash flows discounted at 8% is: $103,567 The present value of $100,000 to be received in two years discounted at 12% is: $79,720 The present value of $100,000 to be recelved in two years discounted at 10% is $82,645 The present value of $100,000 to be received in two years discounted at 8% is: REQUIRED: Select the only true statement among the following (no partial credit on this part); $85,734 The note is impaired because 79.720 96,620 The note isimpaired because 100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts