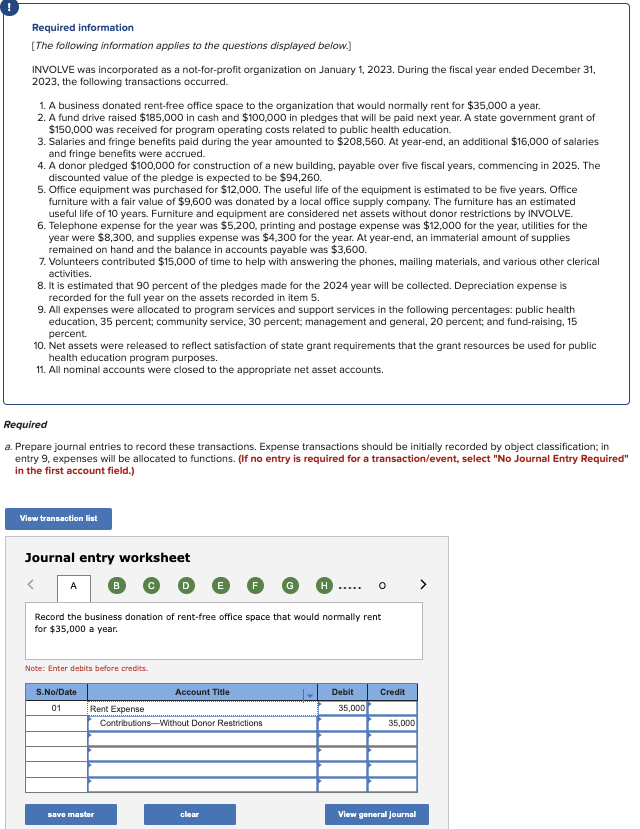

Question: Answer 1 - 1 1 d 1 ) Record the business donation of rent - free office space that would normally rent for $ 3

Answer d

Record the business donation of rentfree office space that would normally rent for $ a year.

Record the $ fund drive raised in cash and $ in pledges that will be paid within one year. A state government grant of $ was received for program operating costs related to public health education.

Record the $ Salaries and fringe benefits paid during the year. At yearend, an additional $ of salaries and fringe benefits were accrued.

Record the $ pledged by donor for construction of a new building, payable over five fiscal years, commencing in The discounted value of the pledge is expected to be $

Record the $ purchase of Office equipment with a useful life of five years. Office furniture worth $ donated by a local office supply company with a useful life of years.

Record the $ Telephone expense, $ printing and postage expense, $ utilities, and $ supplies expense for the year. At yearend, an immaterial amount of supplies remained on hand and the balance in accounts payable was $

Record the $ worth contribution of time by volunteers to help with answering the phones, mailing materials, and various other clerical activities.

aRecord the $ provision for uncollectible pledges.

bRecord the depreciation expenses for the year.

Record the allocation of expenses to program services and support services with public health education, percent; community service, percent; management and general, percent; and fundraising, percent.

Record the release of Net assets to reflect satisfaction of state grant requirements that the grant resources be used for public health education program purposes.

aRecord the closure of all nominal accounts at year end.

bRecord the transfer of contributions to net assets with donor restrictions account.

cRecord the transfer to with donor restrictions account.

dRecord the transfer to an without donor restrictions account.

These are the Accounts selections so apply these selections when inputting the accounts: Accounts payable, Allowance for DepreciationEquipment and Furniture, Allowance for Uncollectible PledgesUnrestricted, Cash, Commission revenue, community art education program, community service program, contributions receviable, contributionswith donor restrictionsprogram, contributionswith donor restrictionstime, contributionswithout donor restrictions, deferred revenue, depreciation expenses, Discount on contributions receviable, equipment and furniture, exhibition program, fundraising, grants receivable, investment incomewith donor restrictions, investment incomewithout donor restrictions, management and general, membership dues, miscellaneous expense, net assets releasedsatisfaction of purpose restrictionwith donor restrictions, net assets releasedsatisfaction of purpose restrictionwithout donor restrictions, net assets with donor restrictions, net assets without donor restrictions, payable to artist prepaid expenses, printing and postage expense, program expenses, provision for uncollectible pledges, public health education program, rent expense, salaries and benefits expense, salaries and benefits payable, shortterm investments, supplies expense, telephone expenses, tuition and fees, utilities expenses, allowance for uncollectible pledges

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock