Question: answer 1 & 2 Question 3 pts In 2019, Owl Co. reported a $200,000 NOL on Form 1120. In 2020, Owl expects taxable income of

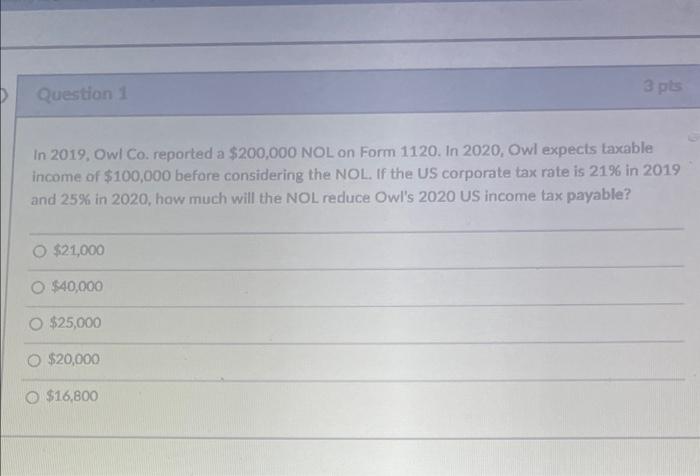

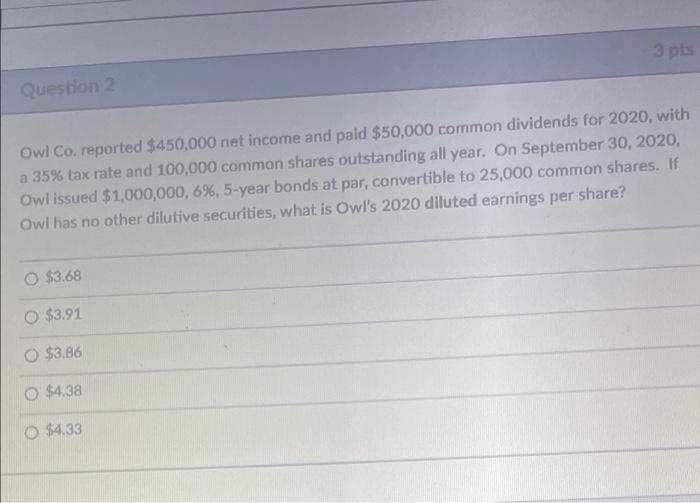

Question 3 pts In 2019, Owl Co. reported a $200,000 NOL on Form 1120. In 2020, Owl expects taxable income of $100,000 before considering the NOL. If the US corporate tax rate is 21% in 2019 and 25% in 2020, how much will the NOL reduce Owl's 2020 US income tax payable? O $21,000 O $40,000 O $25,000 $20,000 $16,800 3 pts Question 2 Owl Co. reported $450,000 net income and paid $50,000 common dividends for 2020, with a 35% tax rate and 100,000 common shares outstanding all year. On September 30, 2020, Owl issued $1,000,000,6%, 5-year bonds at par, convertible to 25,000 common shares. If Owl has no other dilutive securities, what is Owl's 2020 diluted earnings per share? $3.68 O $3.91 $3.86 $4.38 O $4.33

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts