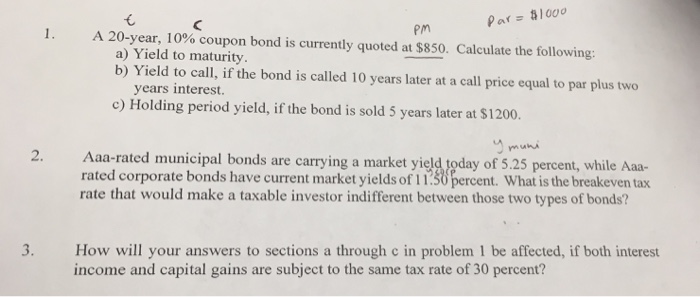

Question: Answer 1 and 3 please A 20-year, 10% coupon bond is currently quotes at $850. Calculate the following: a) Yield to maturity. b) Yield to

Answer 1 and 3 please

Answer 1 and 3 please A 20-year, 10% coupon bond is currently quotes at $850. Calculate the following: a) Yield to maturity. b) Yield to call, if the bond is called 10 years later at a call price equal to par plus two years interest. c) Holding period yield, if the bond is sold 5 years later at $1200. Aaa-rated municipal bonds are carrying a market yield today of 5.25 percent, while Aaa-rated corporate bonds have current market yields of 11.50 percent. What is the breakeven tax rate that would make a taxable investor indifferent between those two types of bonds? How will your answers to sections a through c in problem 1 be affected, if both 'interest income and capital gains are subject to the same tax rate of 30 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts