Question: answer 1. If a company borrows $250,000 for four years at 9%, what would the annual loan payments be? If a company borrows $750,000 for

answer

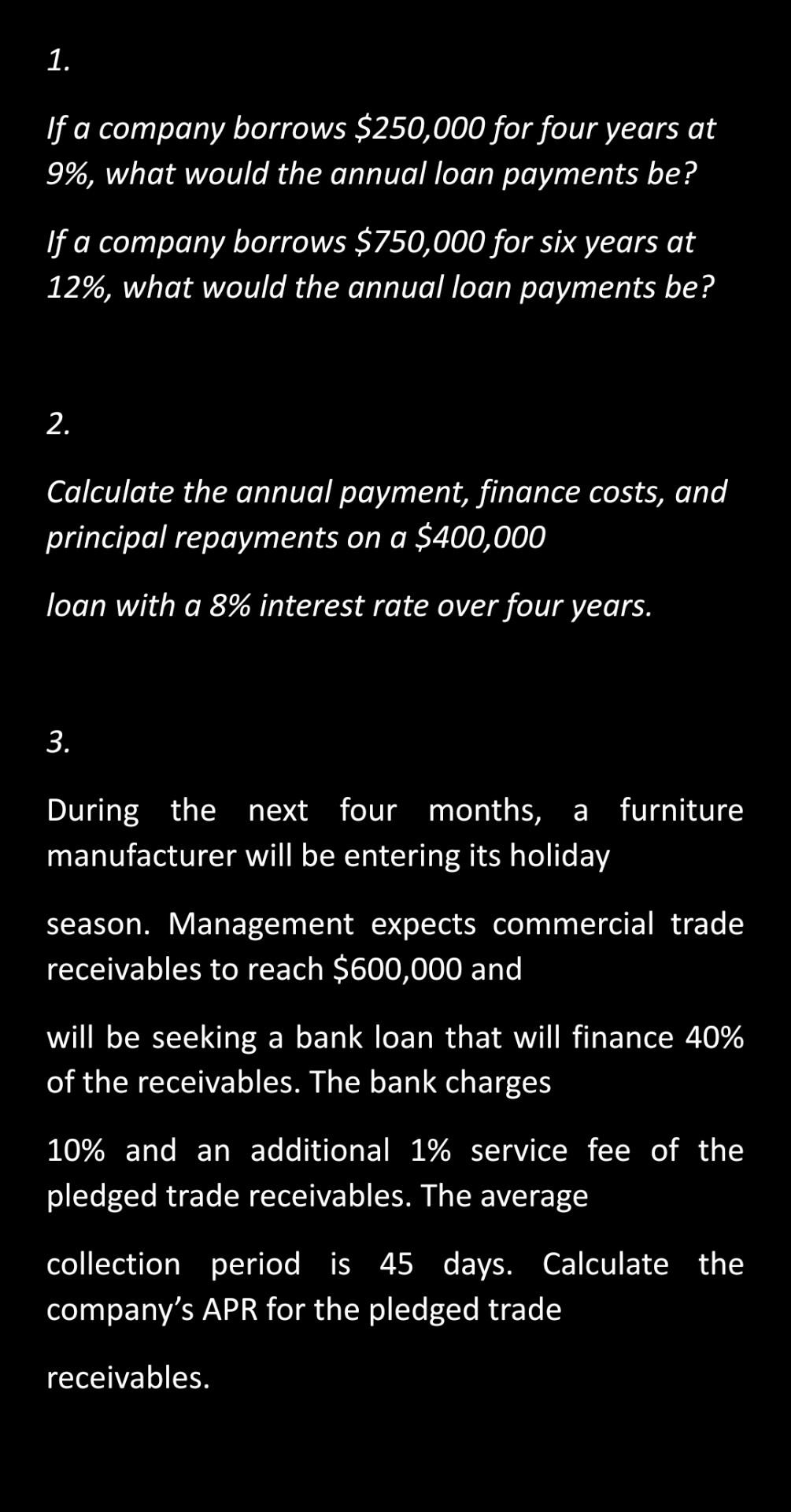

1. If a company borrows $250,000 for four years at 9%, what would the annual loan payments be? If a company borrows $750,000 for six years at 12%, what would the annual loan payments be? 2. Calculate the annual payment, finance costs, and principal repayments on a $400,000 loan with a 8% interest rate over four years. 3. During the next four months, a furniture manufacturer will be entering its holiday season. Management expects commercial trade receivables to reach $600,000 and will be seeking a bank loan that will finance 40% of the receivables. The bank charges 10% and an additional 1% service fee of the pledged trade receivables. The average collection period is 45 days. Calculate the company's APR for the pledged trade receivables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts