Question: Answer 10 & 11 Please 10. According to the EXPECTATIONS THEORY. What is the 3 year expected rate? Rate r = Date Feb 25, 2016

Answer 10 & 11 Please

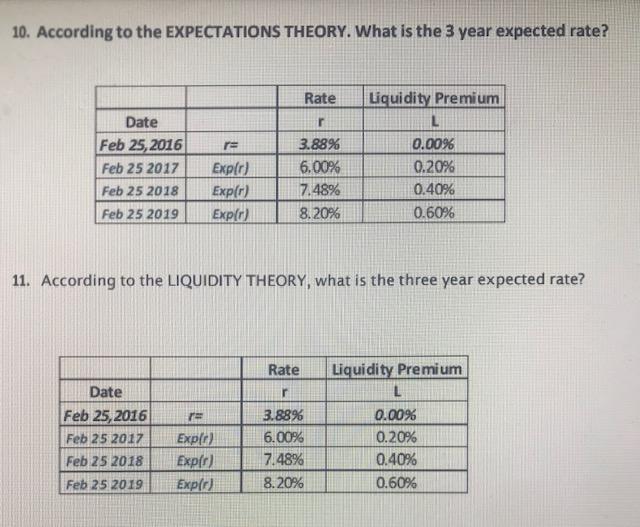

10. According to the EXPECTATIONS THEORY. What is the 3 year expected rate? Rate r = Date Feb 25, 2016 Feb 25 2017 Feb 25 2018 Feb 25 2019 Liquidity Premium L 0.00% 0.20% 0.40% 0.60% 3.88% 6.00% 7.48% 8. 20% Explo) Exp(r) Explo) 11. According to the LIQUIDITY THEORY, what is the three year expected rate? Rate r Date Feb 25, 2016 Feb 25 2017 Feb 25 2018 Liquidity Premium L 0.00% 0.20% 0.40% 0.60% 3.88% 6.00% 7.48% 8.20% Expe) Expir) Expl Feb 25 2019 10. According to the EXPECTATIONS THEORY. What is the 3 year expected rate? Rate r = Date Feb 25, 2016 Feb 25 2017 Feb 25 2018 Feb 25 2019 Liquidity Premium L 0.00% 0.20% 0.40% 0.60% 3.88% 6.00% 7.48% 8. 20% Explo) Exp(r) Explo) 11. According to the LIQUIDITY THEORY, what is the three year expected rate? Rate r Date Feb 25, 2016 Feb 25 2017 Feb 25 2018 Liquidity Premium L 0.00% 0.20% 0.40% 0.60% 3.88% 6.00% 7.48% 8.20% Expe) Expir) Expl Feb 25 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts