Question: answer = 10.70% (show me how to get this using EXCEL) 25. An office building property can be purchased for $3.6 million. It is expected

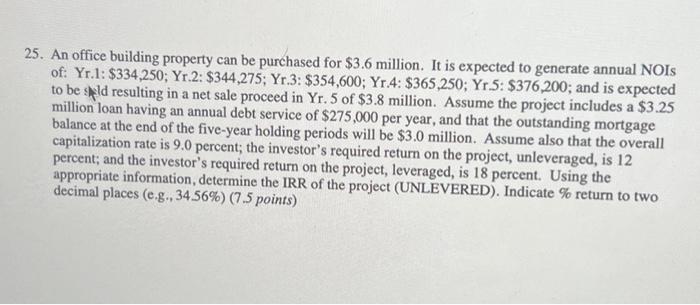

25. An office building property can be purchased for $3.6 million. It is expected to generate annual NOIs of: Yr.1: $334,250; Yr. 2:$344,275; Yr.3: $354,600; Yr.4: $365,250; Yr.5: $376,200; and is expected to be syld resulting in a net sale proceed in Yr. 5 of $3.8 million. Assume the project includes a $3.25 million loan having an annual debt service of $275,000 per year, and that the outstanding mortgage balance at the end of the five-year holding periods will be $3.0 million. Assume also that the overall capitalization rate is 9.0 percent; the investor's required return on the project, unleveraged, is 12 percent; and the investor's required return on the project, leveraged, is 18 percent. Using the appropriate information, determine the IRR of the project (UNLEVERED). Indicate \% return to two decimal places (e.g., 34.56%) ( 7.5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts