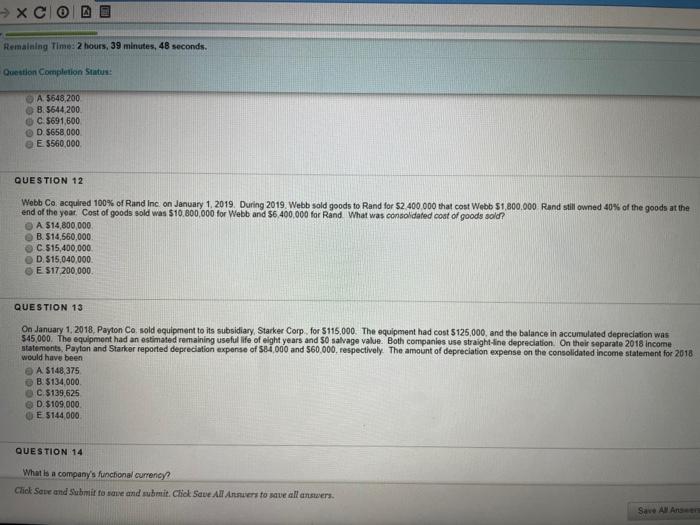

Question: Answer #12 please. Remaining Time: 2 hours, 39 minutes, 48 seconds. Question Completion Status: O A $648,200 8.5644,200 C5691,600 OD 5658.000 E5560 000 QUESTION 12

Remaining Time: 2 hours, 39 minutes, 48 seconds. Question Completion Status: O A $648,200 8.5644,200 C5691,600 OD 5658.000 E5560 000 QUESTION 12 Webb Co acquired 100% of Rand Inc. on January 1, 2019. During 2019. Webb sold goods to Rand for $2.400.000 that cost Webb $1,800.000 Rand still owned 40% of the goods at the end of the year. Cost of goods sold was $10,800,000 for Webb and $6.400,000 for Rand What was consolidated cost of goods sold? A $14,800,000 B. $14,560,000 C.515,400,000 D $15.040,000 E517 200,000 QUESTION 13 On January 1, 2018, Payton Co. sold equipment to its subsidiary Starker Corp. for $115,000 The equipment had cost $125,000, and the balance in accumulated depreciation was 545,000. The equipment had an estimated remaining useful life of eight years and So salvage value. Both companies use straight-line depreciation. On their separate 2018 income statements, Payton and Starker reported depreciation expense of 582 000 and 560.000, respectively. The amount of depreciation expense on the consolidated Income statement for 2018 would have been A $148,375 B. $134.000 C 5139,625 D.$109.000 E 5144 000 QUESTION 14 What is a company's functional currency Click Save and Submit to sue and submit Chick Save All Anniesto save all answers. Save All Ann

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts