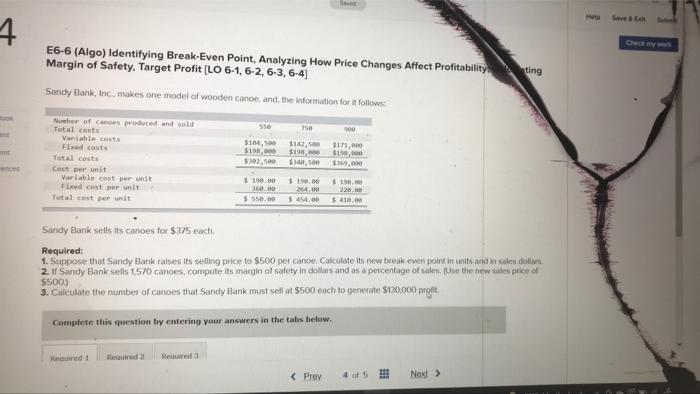

Question: answer 1,2,3 pls 4 E6-6 (Algo) Identifying Break-Even Point, Analyzing How Price Changes Affect Profitability ting Margin of Safety, Target Profit [LO 6-1, 6-2, 6-3,

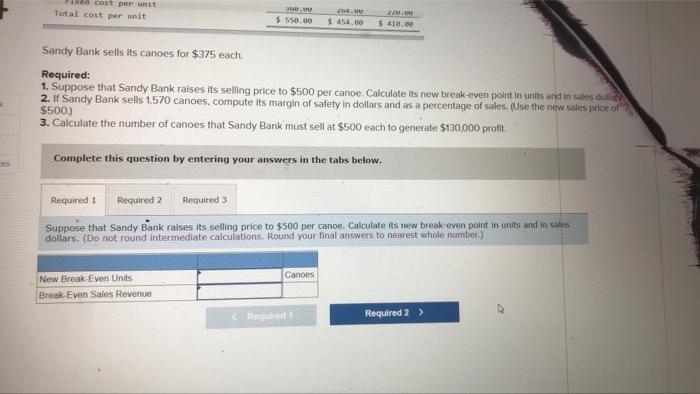

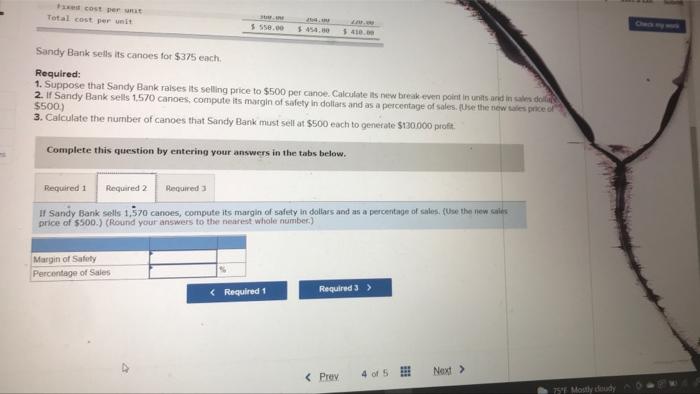

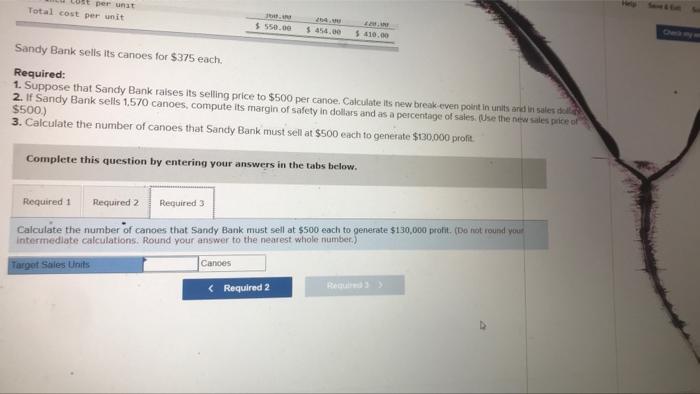

4 E6-6 (Algo) Identifying Break-Even Point, Analyzing How Price Changes Affect Profitability ting Margin of Safety, Target Profit [LO 6-1, 6-2, 6-3, 6-4) Sanidy Bank, Inc, makes one modet of wooden canoe, and the information for at follows 550 soo Number of CS produced and sold Total costs Variable costs Flacoste Total costs Cost per unit Variable cost per unit Fixed cost per unit Total cost per unit $100, $10.000 $102,500 1750 $147,500 $191, 1,500 5173.00 $190.000 . $198.00 360.00 $550.00 190.00 264.00 $49.00 $100.00 220.00 $10.00 Sandy Bank sells its canoes for $375 each Required: 1. Suppose that Sandy Bank raises its selling price to $500 per cance Calculate its new break even point in units and sales de 2. If Sandy Bank sells 1570 canoes, compute its margin of safety in dollars and as a percentage of sales. Use the new sales price of $500) 3. Calculate the number of cances that Sandy Bank must sell at $5.00 each to generate $130,000 piget, Complete this question by entering voor answers in the tabs below. Required 1 Becured Recured 3 od cost per unit Total cost per unit $ 550.00 204, $454.00 $410.00 Sandy Bank sells its canoes for $375 each Required: 1. Suppose that Sandy Bank raises its selling price to $500 per canoe Calculate its new break-even point in units and in sales son 2. If Sandy Bank sells 1.570 canoes, compute its margin of safety in dollars and as a percentage of sales. (Use the new sales price of $500.) 3. Calculate the number of canoes that Sandy Bank must sell at $500 each to generate $130,000 profit. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Suppose that Sandy Bank raises its selling price to $500 per canoe Calculate its new break even point in units and in sales dollars. (Do not round Intermediate calculations. Round your final answers to nearest whole number Canoos New Break-Even Units Break Even Sales Revenue RENO Required 2 > cost per Total cost per unit L. $ 558.00 4. Sandy Bank sells its canoes for $375 each Required: 1. Suppose that Sandy Bank raises its selling price to $500 per canoe Calculate its new break even point in units and in die 2. If Sandy Bank sells 1570 canoes, compute its margin of safety in dollars and as a percentage of sales. Use the new sale price of $500) 3. Calculate the number of canoes that Sandy Bank must sell at $500 each to generate $100.000 profit Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required If Sandy Bank sells 1,570 canoes, compute its margin of safety in dollars and as a percentage of colors. Use the new could price of $500.) (Round your answers to the nearest whole number) Margin of Safety Percentage of Sales 79. Mostly dudy cost per una Total cost per unit $550.00 $49.00 $10.00 Sandy Bank sells its canoes for $375 each. Required: 1. Suppose that Sandy Bank raises its selling price to $500 per canoe Calculate its new break even point in units and in sales del 2. If Sandy Bank sells 1,570 canoes, compute its margin of safety in dollars and as a percentage of sales. (Use the new sales police of $500) 3. Calculate the number of canoes that Sandy Bank must sell at $500 each to generate $130,000 prole Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the number of canoes that Sandy Bank must sell at $500 each to generate $130,000 profit. (Do not round you intermediate calculations. Round your answer to the nearest whole number) Targot Sales Units Cances (Required 2 ROL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts