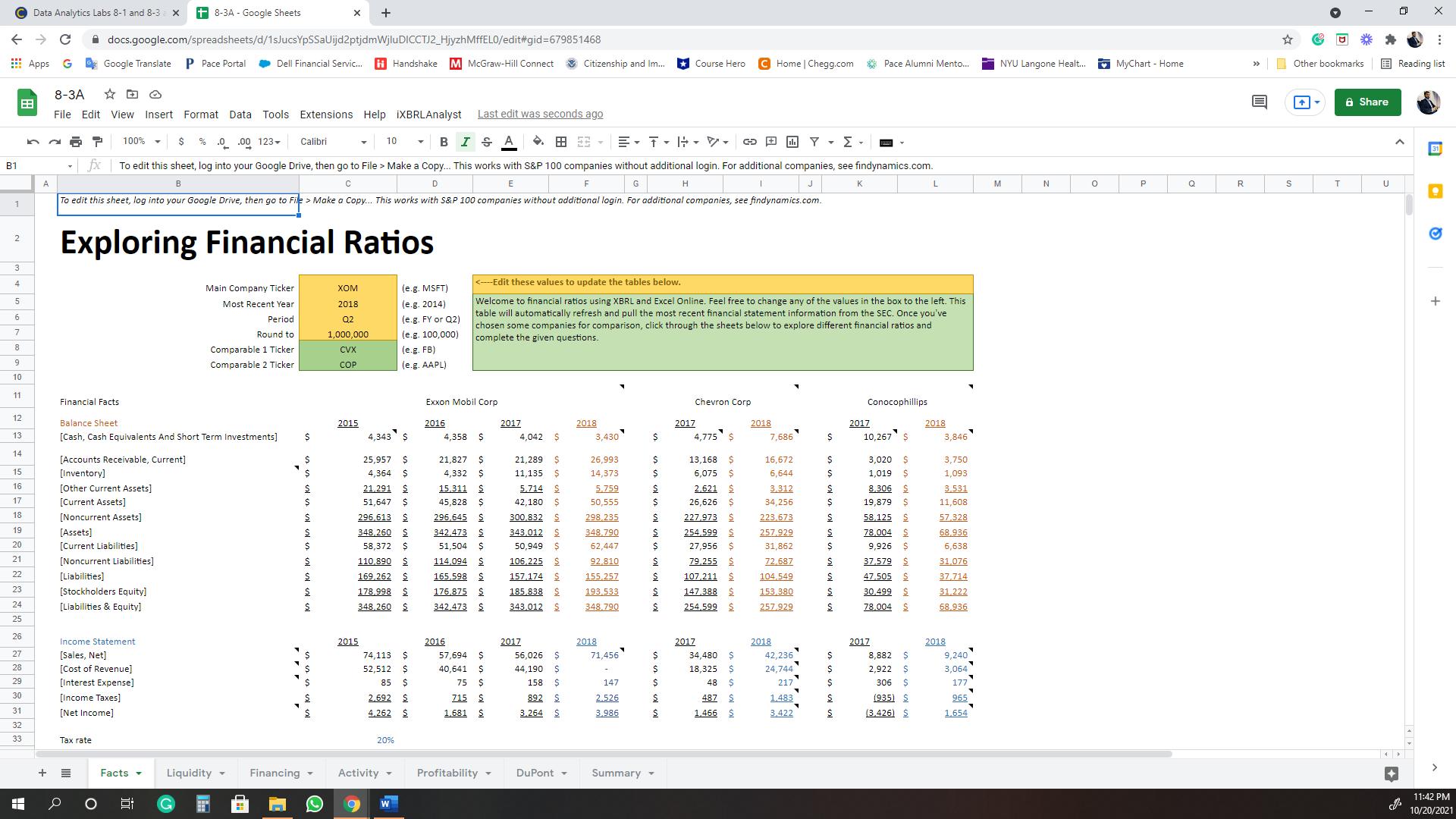

Question: Answer 1-4 based on the link provided: Discuss year 2018 https://docs.google.com/spreadsheets/d/1sJucsYpSSaUijd2ptjdmWjluDICCTJ2_HjyzhMffEL0/edit#gid=679851468 Or, see attachment. Please see all the tabs of the google sheet/link for a

Answer 1-4 based on the link provided: Discuss year 2018

https://docs.google.com/spreadsheets/d/1sJucsYpSSaUijd2ptjdmWjluDICCTJ2_HjyzhMffEL0/edit#gid=679851468

Or, see attachment.

Please see all the tabs of the google sheet/link for a better understanding.

1. Review the 14 financial ratios shown across the tabs and make some conclusions or judgments about the values, trends, or comparisons with the other companies. For example, if one company has a significantly higher debt-to-equity ratio than the other two, what might be driving this?

2. Has the company you are analyzing seen any major changes in its ratios in the past three years? Which of the three companies is most liquid in the most current year?

3. How has your company managed short-term liabilities over the last three years?

4. Analyze liquidity, profitability, financing (leverage), and activity for your company. Where is it strong?

B1 1 2 3 4 5 6 7 Data Analytics Labs 8-1 and 8-3 X +8-3A- Google Sheets X docs.google.com/spreadsheets/d/1sJucsYpSSaUijd2ptjdmWjluDICCTJ2_HjyzhMffELO/edit#gid=679851468 Apps G Google Translate P Pace Portal Dell Financial Servic... Handshake M McGraw-Hill Connect Citizenship and Im... Course Hero Home | Chegg.com Pace Alumni Mento... NYU Langone Healt... 8-3A 188 Last edit was seconds ago File Edit View Insert Format Data Tools Extensions Help iXBRLAnalyst 27 $ %0.00 123- Calibri 100% Y 10 B IS A G 1 fx To edit this sheet, log into your Google Drive, then go to File > Make a Copy... This works with S&P 100 companies without additional login. For additional companies, see findynamics.com. A B C D E F G H 1 J K L M N To edit this sheet, log into your Google Drive, then go to File > Make a Copy.... This works with S&P 100 companies without additional login. For additional companies, see findynamics.com. Exploring Financial Ratios

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

1 The time interest earned ratio is how likely a company will be able to pay back creditors Exxon Mobil is the lowest at 2394 this seems that they are repaying their creditors back too fast and not in... View full answer

Get step-by-step solutions from verified subject matter experts