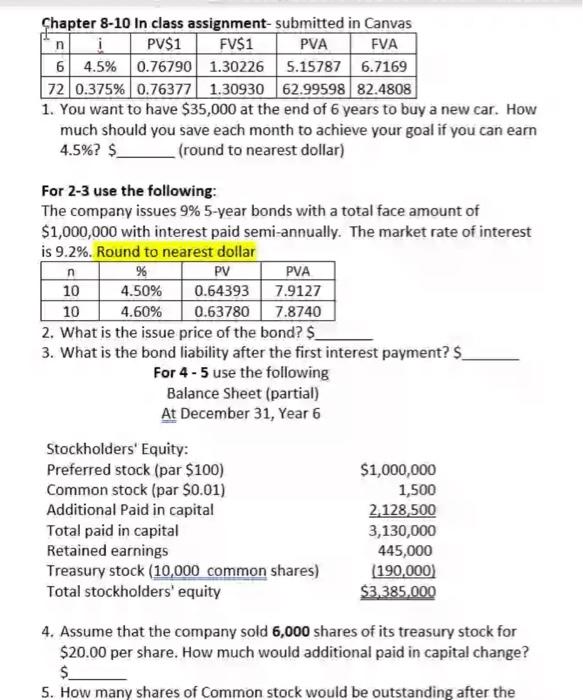

Question: answer 1-5 Chapter 8-10 in class assignment-submitted in Canvas n PV$1 FV$1 PVA FVA 6 4.5% 0.76790 1.30226 5.15787 6.7169 72 0.375% 0.76377 1.30930 62.99598

Chapter 8-10 in class assignment-submitted in Canvas n PV$1 FV$1 PVA FVA 6 4.5% 0.76790 1.30226 5.15787 6.7169 72 0.375% 0.76377 1.30930 62.99598 82.4808 1. You want to have $35,000 at the end of 6 years to buy a new car. How much should you save each month to achieve your goal if you can earn 4.5%? $ _(round to nearest dollar) n 10 For 2-3 use the following: The company issues 9% 5-year bonds with a total face amount of $1,000,000 with interest paid semi-annually. The market rate of interest is 9.2%. Round to nearest dollar % PV PVA 4.50% 0.64393 7.9127 10 4.60% 0.63780 7.8740 2. What is the issue price of the bond? $ 3. What is the bond liability after the first interest payment? $ For 4 - 5 use the following Balance Sheet (partial) At December 31, Year 6 Stockholders' Equity: Preferred stock (par $100) $1,000,000 Common stock (par $0.01) 1,500 Additional Paid in capital 2.128,500 Total paid in capital 3,130,000 Retained earnings 445,000 Treasury stock (10,000 common shares) (190,000) Total stockholders' equity $3.385.000 4. Assume that the company sold 6,000 shares of its treasury stock for $20.00 per share. How much would additional paid in capital change? $ 5. How many shares of Common stock would be outstanding after the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts