Question: answer 1-6 References A- A A Mailings A Review E. E. View . . I Alle AaBbCcD Aanbendite Normal . Strong Chapter 3 1. Find

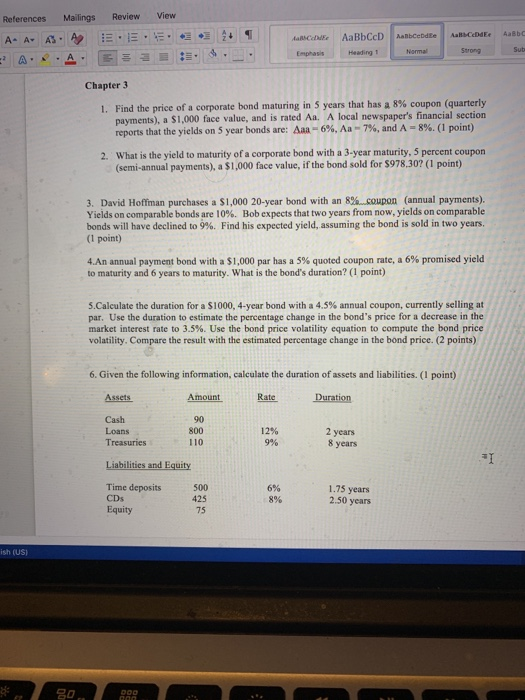

References A- A A Mailings A Review E. E. View . . I Alle AaBbCcD Aanbendite Normal . Strong Chapter 3 1. Find the price of a corporate bond maturing in 5 years that has a 8% coupon (quarterly payments), a $1.000 face value, and is rated Aa. A local newspaper's financial section reports that the yields on 5 year bonds are: Aaa -6%, Aa - 7%, and A-8%. (1 point) 2. What is the yield to maturity of a corporate bond with a 3-year maturity, 5 percent coupon (semi-annual payments), a $1,000 face value, if the bond sold for $978.30? (1 point) 3. David Hoffman purchases a $1,000 20-year bond with an 82 coupon (annual payments). Yields on comparable bonds are 10%. Bob expects that two years from now, yields on comparable bonds will have declined to 9%. Find his expected yield, assuming the bond is sold in two years (1 point) 4.An annual payment bond with a $1,000 par has a 5% quoted coupon rate, a 6% promised yield to maturity and 6 years to maturity. What is the bond's duration? (1 point) 5.Calculate the duration for a $1000, 4-year bond with a 4.5% annual coupon, currently selling at par. Use the duration to estimate the percentage change in the bond's price for a decrease in the market interest rate to 3.5%. Use the bond price volatility equation to compute the bond price volatility. Compare the result with the estimated percentage change in the bond price. (2 points) 6. Given the following information, calculate the duration of assets and liabilities. (I point) Assets Amount Rate Duration Cash Loans Treasures 12% 800 110 9% 2 years 8 years Liabilities and Equity Time deposits CDs 1.75 years 2.50 years Equity ish (USI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts