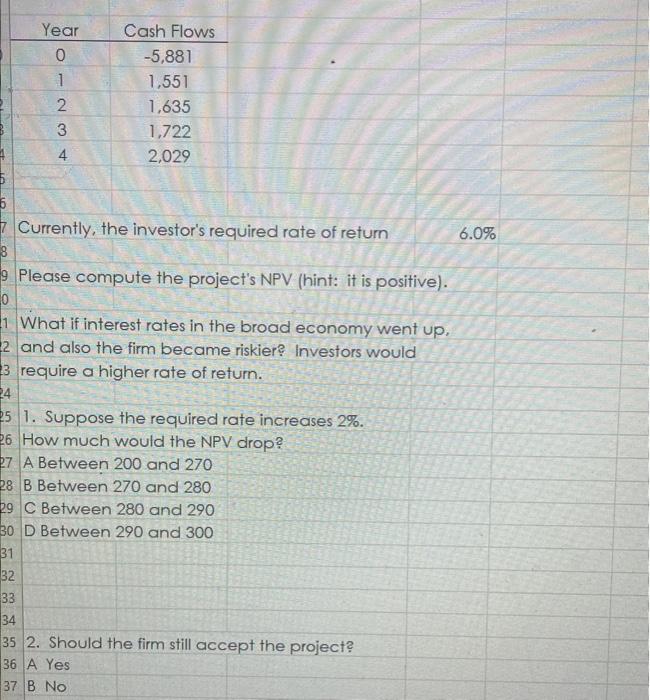

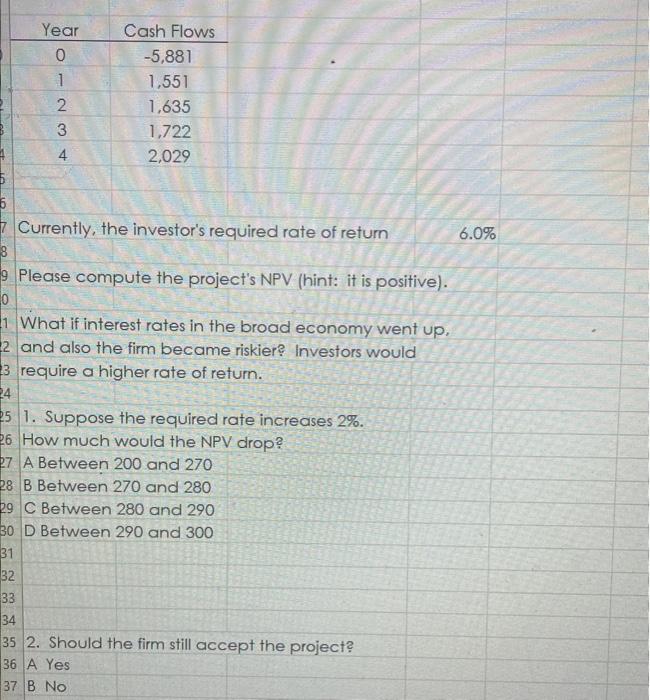

Question: answer #2 please begin{tabular}{|cc|} hline Year & Cash Flows hline 0 & 5,881 1 & 1,551 2 & 1,635 3 &

answer #2 please

\begin{tabular}{|cc|} \hline Year & Cash Flows \\ \hline 0 & 5,881 \\ 1 & 1,551 \\ 2 & 1,635 \\ 3 & 1,722 \\ 4 & 2,029 \\ \hline \end{tabular} Currently, the investor's required rate of return 6.0% Please compute the project's NPV (hint: it is positive). What if interest rates in the broad economy went up. 2 and also the firm became riskier? Investors would require a higher rate of return. 1. Suppose the required rate increases 2%. How much would the NPV drop? A Between 200 and 270 B Between 270 and 280 C Between 280 and 290 D Between 290 and 300 2. Should the firm still accept the project? A Yes B No

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock