Question: Answer 2 questions in Section B 1) Describe what happens in a hypothetical scenario in which a bond issuer defaults. How the issuer's and buyer's

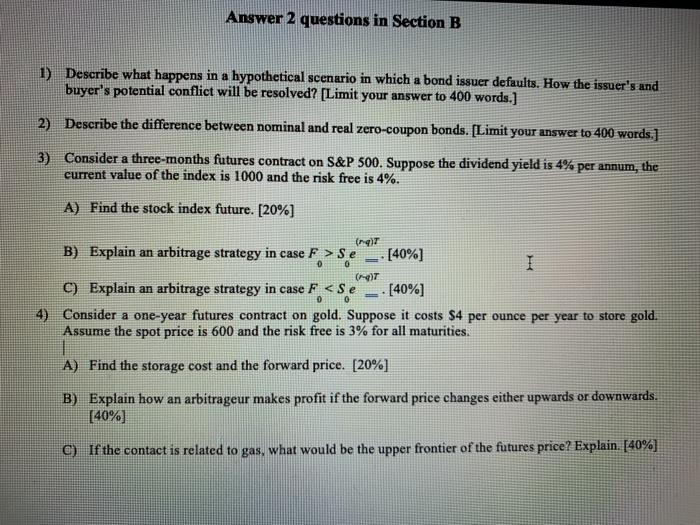

Answer 2 questions in Section B 1) Describe what happens in a hypothetical scenario in which a bond issuer defaults. How the issuer's and buyer's potential conflict will be resolved? [Limit your answer to 400 words.] 2) Describe the difference between nominal and real zero-coupon bonds. [Limit your answer to 400 words ] 3) Consider a three-months futures contract on S&P 500. Suppose the dividend yield is 4% per annum, the current value of the index is 1000 and the risk free is 4%. A) Find the stock index future. [20%) 0 (ne) B) Explain an arbitrage strategy in case F > Se [40%) I (-) C) Explain an arbitrage strategy in case F

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts