Question: Answer 22 & 23 4 pts D Question 22 Owl Co. signs a 10-month lease and pays $225,000 to Fox Co. on March 15, 2020:

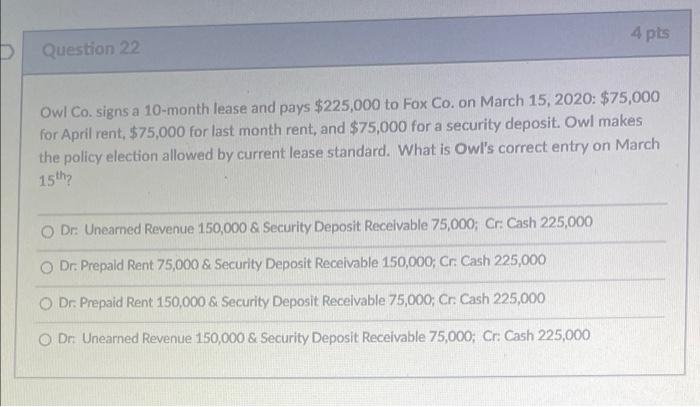

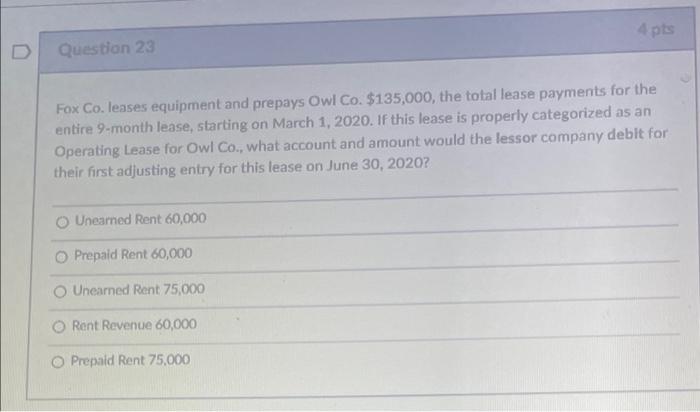

4 pts D Question 22 Owl Co. signs a 10-month lease and pays $225,000 to Fox Co. on March 15, 2020: $75,000 for April rent, $75,000 for last month rent, and $75,000 for a security deposit. Owl makes the policy election allowed by current lease standard. What is Owl's correct entry on March 15th O Dr: Unearned Revenue 150,000 & Security Deposit Receivable 75,000; Cr: Cash 225,000 O Dr. Prepaid Rent 75,000 & Security Deposit Receivable 150,000; Cr: Cash 225,000 O Dr. Prepaid Rent 150,000 & Security Deposit Recelvable 75,000; Cr: Cash 225,000 O Dr Unearned Revenue 150,000 & Security Deposit Receivable 75,000; Cr: Cash 225,000 Apts D Question 23 Fox Co. leases equipment and prepays Owl Co. $135,000, the total lease payments for the entire 9-month lease, starting on March 1, 2020. If this lease is properly categorized as an Operating Lease for Owl Co., what account and amount would the lessor company debit for their first adjusting entry for this lease on June 30, 2020? Unearned Rent 60,000 O Prepaid Rent 60,000 Unearned Rent 75,000 Rent Revenue 60,000 O Prepaid Rent 75,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts