Question: Answer 3 (3)A U.S based MNC, the Cody Company, will receive trmine its tomorrow for its exports to an importer in Mexico. It million Mexican

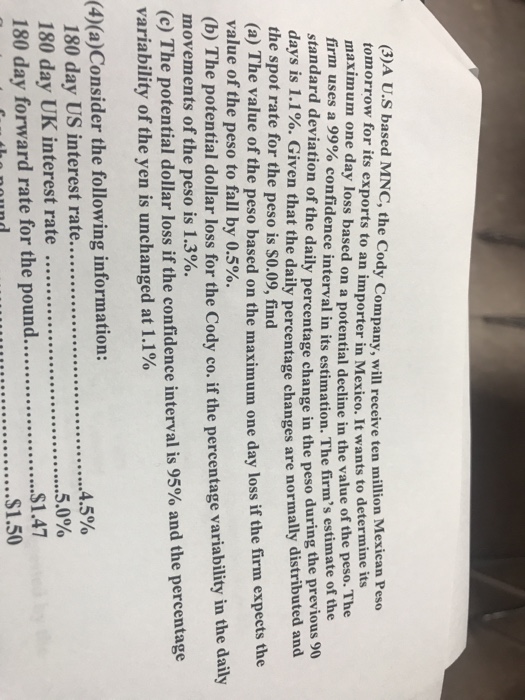

(3)A U.S based MNC, the Cody Company, will receive trmine its tomorrow for its exports to an importer in Mexico. It million Mexican Peso ten maximum one day loss based on a potential decline in the he peso. T The firm uses a 99% confidence interval in its estimation. The firm's estimate of the standard deviation of the daily percentage change in the peso durngistributed and days is 1.1%. Given that the d the spot rate for the peso is $0.09, find (a) The value of the peso based on the maximum one day loss if the firm expects the value of the peso to fall by 0.5%. (b) The potential dollar loss for the Cody co. movements of the peso is 1.3%. the previous 90 aily percentage changes are normally distributed and if the percentage variability in the daily (c) The potential dollar loss if the confidence interval is 95% and the percentage variability of the yen is unchanged at 1.1% (4) (a)Consider the following information: 180 day US interest rate..45% 180 day UK interest rate 5.0% 180 day forward rate for the pound.$1.47

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts