Question: Answer 3 and 4 please. Thanks Work Sheet #6 Put-Call parity Consider the case of European IBM call and put options that have exercise price

Answer 3 and 4 please. Thanks

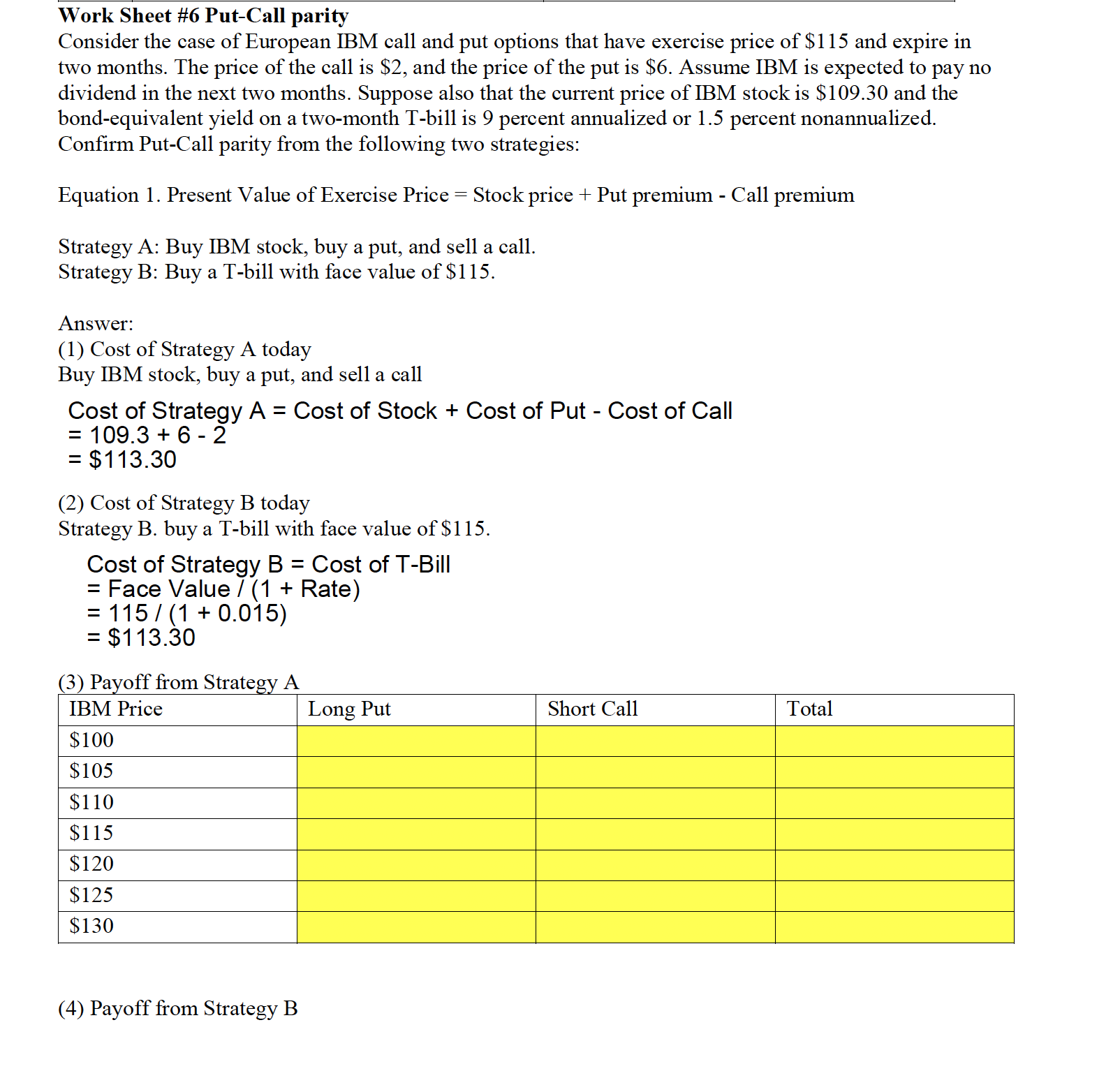

Work Sheet \#6 Put-Call parity Consider the case of European IBM call and put options that have exercise price of $115 and expire in two months. The price of the call is $2, and the price of the put is $6. Assume IBM is expected to pay no dividend in the next two months. Suppose also that the current price of IBM stock is $109.30 and the bond-equivalent yield on a two-month T-bill is 9 percent annualized or 1.5 percent nonannualized. Confirm Put-Call parity from the following two strategies: Equation 1. Present Value of Exercise Price = Stock price + Put premium - Call premium Strategy A: Buy IBM stock, buy a put, and sell a call. Strategy B: Buy a T-bill with face value of $115. Answer: (1) Cost of Strategy A today Buy IBM stock, buy a put, and sell a call Cost of Strategy A= Cost of Stock + Cost of Put - Cost of Call =109.3+62 =$113.30 (2) Cost of Strategy B today Strategy B. buy a T-bill with face value of $115. Cost of Strategy B = Cost of T-Bill = Face Value /(1+ Rate ) =115/(1+0.015) =$113.30 a D D.maff f.am Ct.antan, 1 (4) Payoff from Strategy B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts