Question: Answer #3 only For clear questions click this gdrive link: https://docs.google.com/document/d/1xw6bwcgHCrfkLoEbowHAZT37qlmIRRm8AfleiwSY5Ec/edit _PROBLEMS J _ 1. A and B are partners sharing profits and losses 60%

Answer #3 only

For clear questions click this gdrive link:

https://docs.google.com/document/d/1xw6bwcgHCrfkLoEbowHAZT37qlmIRRm8AfleiwSY5Ec/edit

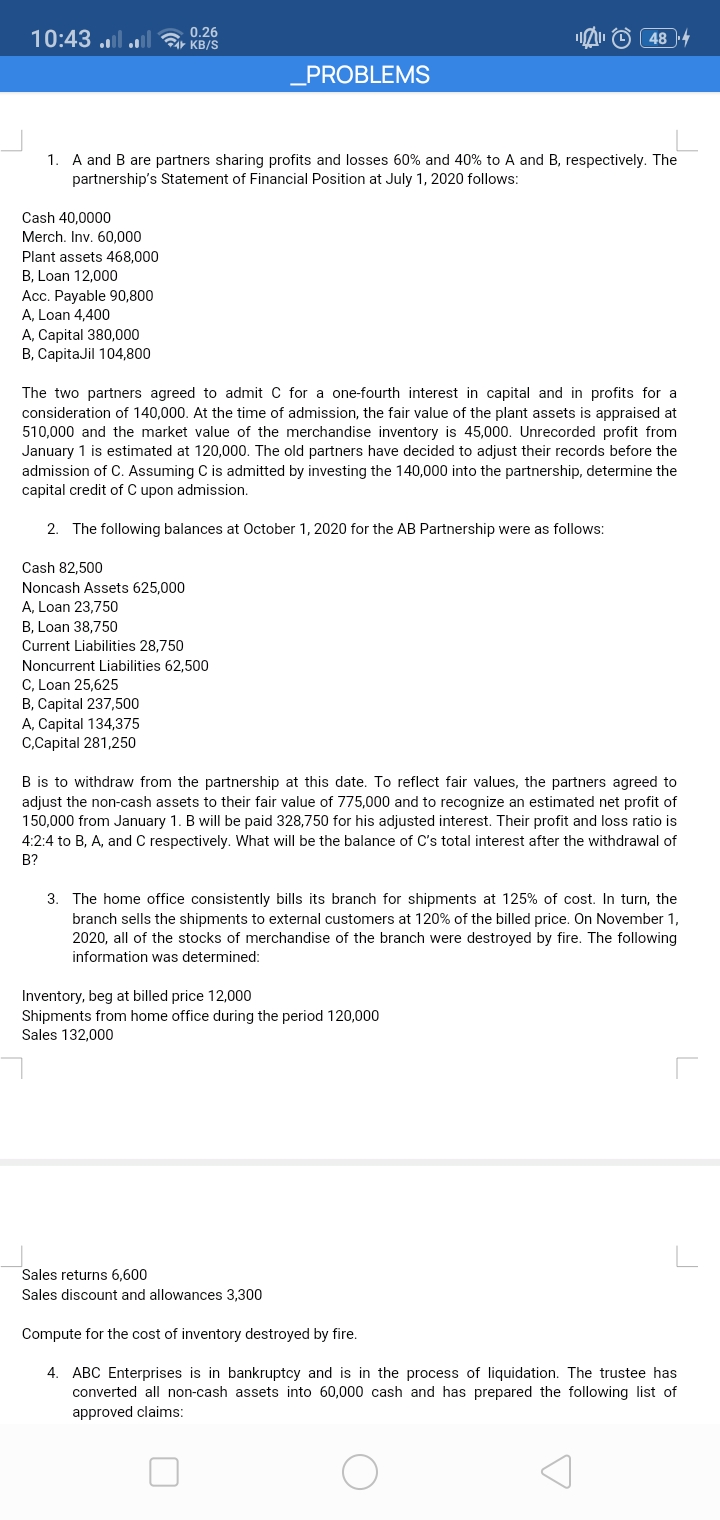

_PROBLEMS J _ 1. A and B are partners sharing profits and losses 60% and 40% to A and B. respectively. The partnership's Statement of Financial Position at July 1, 2020 follows: Cash 40,0000 Merch. Inv. 60.000 Plant assets 468,000 B. Loan 12000 Acc. Payable 90,800 A. Loan 4,400 A. Capital 380000 B. CapitaJil 104.800 The two partners agreed to admit C for a onefourth interest in capital and in profits for a consideration of 140.000. At the time of admission, the fair value of the plant assets is appraised at 510,000 and the market value of the merchandise inventory is 45.000. Unrecorded profit from January 1 is estimated at 120,000. The old partners have decided to adjust their records before the admission of 0. Assuming C is admitted by investing the 140,000 into the partnership. determine the capital credit of 0 upon admission. 2. The following balances at October 1r 2020 for the AB Partnership were as follows: Cash 82,500 Noncash Assets 625,000 A, Loan 23,250 E. Loan 38,250 Current Liabilities 28,?50 Noncurrent Liabilities 62500 0. Loan 25,625 E. Capital 232.500 A. Capital 134.325 0.0ap'rtal 281250 B is to withdraw from the partnership at this date. To reflect fair values. the partners agreed to adjust the noncash assets to their fair value of 225.000 and to recognize an estimated net profit of 150.000 from January 1. B will be paid 328,?50 for his adjusted interest. Their profit and loss ratio is 42:4 to B, A. and C respectively. What will be the balance of 0's total interest after the withdrawal of B? 3. The home ofce consistently bills 'rts branch for shipments at 125% of cost. In turn, the branch sells the shipments to external customers at 120% of the billed price. On November 1. 2020, all of the stocks of merchandise of the branch were destroyed by fire. The following information was determined: Inventory. beg at billed price 12000 Shipments from home office during the period 120.000 Sales 132000 A Sales returns 6.600 Sales discount and allowances 3.300 Compute for the cost of inventory destroyed by fire. 4. ABC Enterprises is in bankruptcy and is in the process of liquidation. The trustee has converted all noncash assets into 60.000 cash and has prepared the following list of approved claims: D 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts