Question: answer 31 & 32 D Question 31 4 pts During 2020, Fox Co. had 100,000 common shares authorized with 40,000 issued and 35,000 outstanding. At

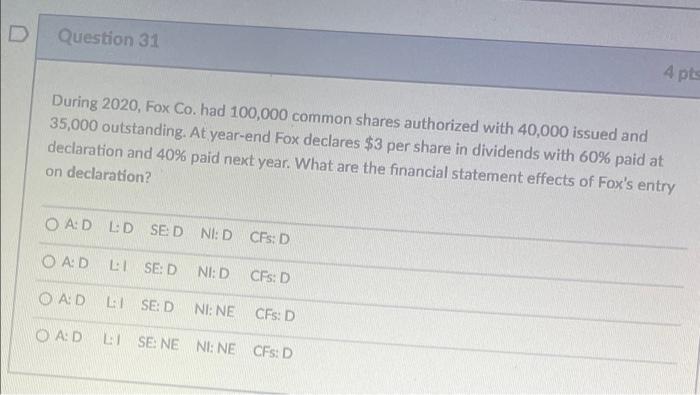

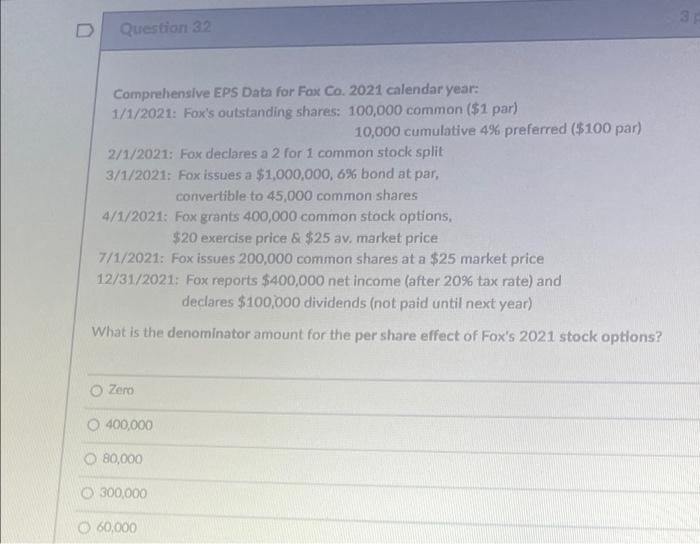

D Question 31 4 pts During 2020, Fox Co. had 100,000 common shares authorized with 40,000 issued and 35,000 outstanding. At year-end Fox declares $3 per share in dividends with 60% paid at declaration and 40% paid next year. What are the financial statement effects of Fox's entry on declaration? OAD LD SED NID CF: D O AD LISED NI:D CFs: D OAD LISED NI: NE CFS: D OAD LI SE NE NI: NE CFs: D 3 D Question 32 Comprehensive EPS Data for Fox Co. 2021 calendar year: 1/1/2021: Fox's outstanding shares: 100,000 common ($1 par) 10,000 cumulative 4% preferred ($100 par) 2/1/2021: Fox declares a 2 for 1 common stock split 3/1/2021: Fox issues a $1,000,000, 6% bond at par, convertible to 45,000 common shares 4/1/2021: Fox grants 400,000 common stock options, $20 exercise price & $25 av, market price 7/1/2021: Fox issues 200,000 common shares at a $25 market price 12/31/2021: Fox reports $400,000 net income (after 20% tax rate) and declares $100,000 dividends (not paid until next year) What is the denominator amount for the per share effect of Fox's 2021 stock options? Zero 400,000 80,000 0 300,000 60,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts