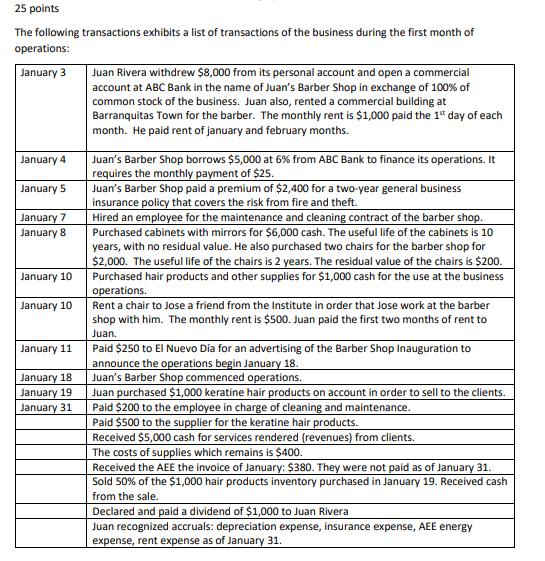

Question: Answer: 25 points The following transactions exhibits a list of transactions of the business during the first month of operations: January 3 January 4 January

Answer:

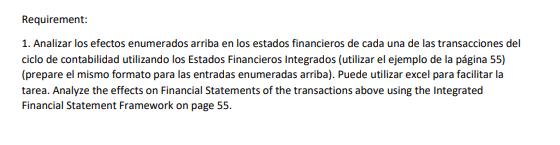

25 points The following transactions exhibits a list of transactions of the business during the first month of operations: January 3 January 4 January 5 January 7 January 8 January 10 January 10 January 11 January 18 January 19 January 31 Juan Rivera withdrew $8,000 from its personal account and open a commercial account at ABC Bank in the name of Juan s Barber Shop in exchange of 100% of common stock of the business. Juan also, rented a commercial building at Barranquitas Town for the barber. The monthly rent is $1,000 paid the 1st day of each month. He paid rent of january and february months. Juan s Barber Shop borrows $5,000 at 6% from ABC Bank to finance its operations. It requires the monthly payment of $25. Juan s Barber Shop paid a premium of $2,400 for a two-year general business insurance policy that covers the risk from fire and theft. Hired an employee for the maintenance and cleaning contract of the barber shop. Purchased cabinets with mirrors for $6,000 cash. The useful life of the cabinets is 10 years, with no residual value. He also purchased two chairs for the barber shop for $2,000. The useful life of the chairs is 2 years. The residual value of the chairs is $200. Purchased hair products and other supplies for $1,000 cash for the use at the business operations. Rent a chair to Jose a friend from the Institute in order that Jose work at the barber shop with him. The monthly rent is $500. Juan paid the first two months of rent to Juan. Paid $250 to El Nuevo Da for an advertising of the Barber Shop Inauguration to announce the operations begin January 18. Juan s Barber Shop commenced operations. Juan purchased $1,000 keratine hair products on account in order to sell to the clients. Paid $200 to the employee in charge of cleaning and maintenance. Paid $500 to the supplier for the keratine hair products. Received $5,000 cash for services rendered (revenues) from clien The costs of supplies which remains is $400. Received the AEE the invoice of January: $380. They were not paid as of January 31. Sold 50% of the $1,000 hair products inventory purchased in January 19. Received cash from the sale. Declared and paid a dividend of $1,000 to Juan Rivera Juan recognized accruals: depreciation expense, insurance expense, AEE energy expense, rent expense as of January 31. Requirement: 1. Analizar los efectos enumerados arriba en los estados financieros de cada una de las transacciones del ciclo de contabilidad utilizando los Estados Financieros Integrados (utilizar el ejemplo de la pgina 55) (prepare el mismo formato para las entradas enumeradas arriba). Puede utilizar excel para facilitar la tarea. Analyze the effects on Financial Statements of the transactions above using the Integrated Financial Statement Framework on page 55.

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Statement of Cash Flow Financing 8000 Financing 6000 ... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

626bb1bc72ed1_93888.docx

120 KBs Word File