Question: answer 4 option b immediately image has been updated 4 Alba Alba AaBbce ABC ABC ABC Normal Body Test 1 Last Para No Space 1

answer 4 option b immediately

image has been updated

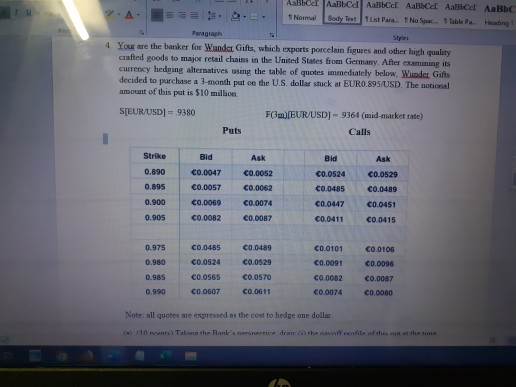

4 Alba Alba AaBbce ABC ABC ABC Normal Body Test 1 Last Para No Space 1 table a Heading Paragraph Style You are the banker for Wunder Gifts, which experts porcelain figures and other high quality crafted goods to major retail chains in the United States from Germany. After examining its currency hedging alternatives using the table of quotes immediately below. Wunder Gifts decided to purchase a 3-month put on the US dollar stuck at EURO.89S/USD The notional amount of this put is $10 million S[EUR/USD = 9380 F3m) [EUR/USDJ-9361 (mid-market rate) Calls Puts Strike Bid Ask 0.899 0.895 C0.0047 CO.0057 C0.0069 C0.0082 CO.0052 0.0062 C0.0074 C0.0087 Bid C0.0524 C0.0485 C0.0447 C0.0411 Ask C0.0529 0.0489 C0.0451 0.0415 0.900 0.905 0.975 0.980 0.985 C0.0485 C0.0524 C0.0565 CO.0607 C0.0489 CO.0529 C0.0570 C0.0611 C0.0101 C0.0091 C0.0082 0.0074 0.0105 C0.0096 C0.0087 CO.0080 0.990 Note: all quotes are expressed as the cost to hedge one dollar in 10 mins Tale the Ranke d the file that the Paragraph Styles b) (8 points) Using mid-market values, calculate the approximate delta of this put option from the Bank's perspective. What forward transaction would the Bank execute in order to delta hedge this option? (7 points) If Wunder Gifts sells a EURO 985 USD call on S10 million in order to offset its purchase of the EURO 895/USD put, what is the net premium amount of these two 4 Alba Alba AaBbce ABC ABC ABC Normal Body Test 1 Last Para No Space 1 table a Heading Paragraph Style You are the banker for Wunder Gifts, which experts porcelain figures and other high quality crafted goods to major retail chains in the United States from Germany. After examining its currency hedging alternatives using the table of quotes immediately below. Wunder Gifts decided to purchase a 3-month put on the US dollar stuck at EURO.89S/USD The notional amount of this put is $10 million S[EUR/USD = 9380 F3m) [EUR/USDJ-9361 (mid-market rate) Calls Puts Strike Bid Ask 0.899 0.895 C0.0047 CO.0057 C0.0069 C0.0082 CO.0052 0.0062 C0.0074 C0.0087 Bid C0.0524 C0.0485 C0.0447 C0.0411 Ask C0.0529 0.0489 C0.0451 0.0415 0.900 0.905 0.975 0.980 0.985 C0.0485 C0.0524 C0.0565 CO.0607 C0.0489 CO.0529 C0.0570 C0.0611 C0.0101 C0.0091 C0.0082 0.0074 0.0105 C0.0096 C0.0087 CO.0080 0.990 Note: all quotes are expressed as the cost to hedge one dollar in 10 mins Tale the Ranke d the file that the Paragraph Styles b) (8 points) Using mid-market values, calculate the approximate delta of this put option from the Bank's perspective. What forward transaction would the Bank execute in order to delta hedge this option? (7 points) If Wunder Gifts sells a EURO 985 USD call on S10 million in order to offset its purchase of the EURO 895/USD put, what is the net premium amount of these two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts