Question: answer 450 and 2114.88 are incorrect for these. please be clear with answer will upvote. QUESTION 4 Manny, a calendar.year taxpayer, uses the cash method

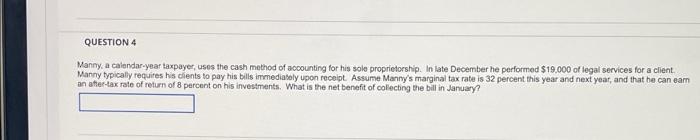

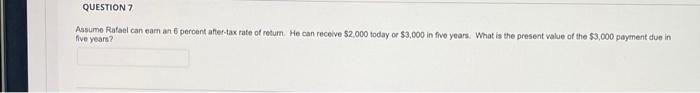

QUESTION 4 Manny, a calendar.year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December he performed $19.000 of legal services for a client Manny typically requires his clients to pay his bills immediately upon receipt Assume Manny's marginal tax rate is 32 percent this year and next year, and that he can eam an after-tax rate of return of 8 percent on his investments. What is the net benefit of collecting the bill in January? QUESTION 7 Assume Rafael cancaman 6 percent after-tax rate of return. He can receive $2,000 today or $3,000 in five years. What is the present value of the $3,000 payment due in five years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts